It is that time of the year that you are supposed to file your 2022 Kenya Revenue Authority (KRA) individual and Nil returns online. Remember that you can file the returns online at the iTax portal (https://itax.kra.go.ke/KRA-Portal/) or by using the iTax Android Mobile App or even visiting your nearest ‘Huduma’ Centre.

How to file nil returns by using the iTax Android Mobile App

Filing your Kenya Revenue Authority, KRA, nil returns has now been made very very easy. This is because KRA has developed a mobile phone Application that enables you file the returns in the shortest time possible.

You no longer need to visit a Cyber to file your returns nor stay in long queues at Huduma Centres.

This guide will show you how to easily file your KRA Nil returns via your mobile phone:

- To access the KRA services, download the iTax App by the Kenya Revenue Authority from Google Play Store by using an Android Mobile phone.

- Open play store and search for the iTax App by KRA and install it.

- Once installed, open the App. A prompt window will emerge asking you to enter your KRA PIN and iTax. password.

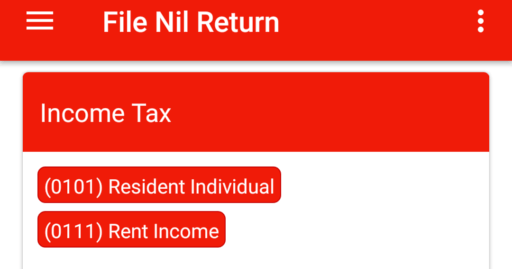

- Once logged in, click ‘Home’ and select the ‘Income Tax’ Obligation.

- The tax period will be auto populated by the App. Click on ‘Submit’.

- A message is then generated to confirm that a Nil return is being filed, thus; ‘Dear Taxpayer, filing of Nil Returns is only applicable in cases where you have NO transactions to declare for the period. Are you sure you want to file Nil Return?’ Click on ‘OK’ to confirm.

- A success message is populated to confirm Successful filing of the Nil Return, thus; ‘iTax Success: Your return has been filed successfully with Acknowledgement Number (KRA/YEAR/NUMBER). Please visit iTax KRA web portal to view filed return.

And with this, you could have successfully filed your Nil returns. Remember to file your returns before the expiry of the stipulated period as set by KRA to avoid late submission penalties.

RELATED CONTENT

- How to easily reset your KRA iTax PIN

- The TSC P9 form for teachers: How to download and use the P9 form in filing KRA tax returns

Simplified procedure for filling 2022/2023 KRA returns, online:

Every individual with a PIN has been required to file their income tax returns for every year of income by 30th June of the following year. For this year the deadline will be June 30, 2023.

This is a statutory requirement that if not met will attract penalties. Filing of returns also helps you to ascertain that what was deducted from your income as tax by your employer was actually remitted to KRA.

To successfully file your KRA returns the following are required:

- An internet enabled device (Mobile phone or computer)

- A P9 form from your employer.

- KRA PIN.

- iTax password.

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Portal

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

STEP BY STEP GUIDE TO FILING YOUR 2022/2023 KRA RETURNS

- GETTING YOUR P9 FORM: Ensure you have downloaded, printed or screen shot your P9 form from the TSC online portal at: http://payslip.tsc.go.ke/login.php

- LOGGING INTO THE KRA ITAX PORTAL: Then, log into the KRA’s ITax portal by typing: https://itax.kra.go.ke/KRA-Portal/ into your browser.

- Enter your KRA pin (read from your P9 form) and click on login. On the next window, enter your password and security stamp and click on (Remember, you can regenerate your password in case you forgot one by using the FORGOT PASSWORD/UNLOCK ACCOUNT hyperlink on the same dialog box).

- Once logged in; click on E-Return hyperlink and in the next dialog box, select Tax Obligation as income Tax – Resident Individual. Now click on Next.

- DOWNLOADING THE EXCEL SHEET: On the next window. Select.. Click here to download Income Tax- Resident Individual Form (Excel).

- FILLING THE EXCEL SHEET FORM. Ensure your computer has Microsoft office Service Pack 2 or higher version of Office.

- Locate the excel sheet form and open it and fill in the parts, thus:

SECTION A PART 1:

- Personal Identification Number: Your KRA PIN

- Type of Return: Original

- Return Period From: 01/01/2022

- Return Period To: 31/12/2022

- Do you have any income other than employment income: As Appropriate for your case

- Do you have partnership income: As Appropriate for your case

- Do you have estate trust income?: As Appropriate for your case

- Has your employer provided you with a car?: NO

- Do you have a mortgage?: As Appropriate for your case

- Do you have a Home Ownership Savings Plan?: As Appropriate for your case

- Do you have a life insurance policy?: As Appropriate for your case

- Do you have a commercial vehicle?: As Appropriate for your case

- Do you earn any income from a foreign country?: As Appropriate for your case

- Have you been issued with the exemption certificate for disability?: As Appropriate for your case

- Do you want to declare Wife’s income?: As Appropriate for your case (Though easier when each declares separately)

Related news;

- Step by step guide on how to reset your KRA password

- P9 form for Public servants from the public service payroll portal https://www.ghris.go.ke/ portal: County and national government employees

- TSC P9 Form from Payslips Portal: How to download and use the P9 form for TSC Teachers

- KRA Tax Returns: How to enable Macros in Microsoft Office Excel when filling Individual income tax

- Step by step guide on how to reset your KRA password

SECTION A PART 2: BANK DETAILS:

- BANK NAME: As Appropriate for your case

- BRANCH NAME: As Appropriate for your case

- CITY: As Appropriate for your case

- ACCOUNT HOLDER’S NAME: As Appropriate for your case

- ACCOUNT NUMBER: As Appropriate for your case

- SECTION A PART 3: DETAILS OF AUDITOR: As Appropriate for your case

- SECTION A PART 4: LAND LORD DETAILS (SELF): As Appropriate for your case

- SECTION A PART 5: TENANT DETAILS (SELF): As Appropriate for your case

- SECTION A PART 5: TENANT DETAILS (WIFE):

NB: AVOID PART 3-5 IF NOT APPLICABLE.

- SECTION A PART 6: DEATAILS OF EXEMPTION CERTIFICATE FOR DISABILITY (SELF AND WIFE): As Appropriate for your case

- SECTION F: DETAILS OF EMPLOYMENT INCOME(SELF & WIFE)

- PIN OF EMPLOYER: P051098084N

- NAME OF EMPLOYER: TSC

- GROSS PAY: (SUBTOTALS + ARREARS as on P9 form)

- Allowances and benefits from employer (i.e hardship) other than car and housing: As Appropriate for your case

- SECTION J: COMPUTATION OF MORTGAGE INTEREST (SELF & WIFE): Avoid if not applicable

- SECTION M: DETAILS OF PAYE DEDUCTED AT SOURCE FROM SALARY (SELF & WIFE)

- PIN OF EMPLOYER: P051098084N

- NAME OF EMPLOYER: TSC

- TAXABLE SALARY: (SUBTOTALS + ARREARS as on P9 form)

- TAX PAYABLE ON TAXABLE SALARY: PAY AUTO(PAYE) + RELIEF as in P9 form

- AMOUNT OF TAX DEDUCTED (PAYE): PAY AUTO(PAYE); as in P9 form

- AMOUNT OF TAX PAYABLE OR REFUNDED (PAYE): Ensure the Amount of Relief displayed here corresponds to that on your P9 form

- SECTION Q: DETAILS OF INCOME TAX PAID IN ADVANCE (SELF): As applicable for your case. But mostly not applicable for many if not all. Thus, leave it blank.

- SECTION T: TAX COMPUTATION:

- No. 11.1: DEFINED/ PENSION CONTRIBUTION: 00

- No. 12.6: PERSONAL RELIEF: Enter Total MPR Value as in P9 form.

- No. 13.4: 00

- No.: 13.5: 00

- CLICK ON VALIDATE TAB (Check properly that all fields are entered correctly and that the tax due is zero or close to zero!)

- You will be prompted to save the sheets. Click on yes. Once validated, the form will be saved in drive c..Location Path: C/user/docs/date….._ITR.zip

- UPLOADING THE FORM:

- Go back to your ITAX Account on your browser.

- UNDER THE INCOME TAX-RESIDENT INDIVIDUAL FORM:

- TYPE OF RETURN: ORIGINAL

- RETURN PERIOD FROM: 1/1/2018

- RETURN PERIOD TO: 31/12/2018

- UPLOAD FORM: Locate the form in drive C and double click on it

- CHECK THE I AGREE TO THE TERMS AND CONDITIONS BUTTON.

- CLICK ON

For latest news click on this link: Updated news portal

DOWNLOADING THE E-RETURN ACKNOWLEDGEMENT RECEIPT:

Evidence of upload is very essential. Ensure to save such evidence, just in case..!

- Once successfully uploaded, a tab “e-Return Acknowledge Receipt” is displayed.

- Click on it to down load it to your local PC…. Save a soft copy… print a hard copy (Back-up manenos!)

- Remember to locate a copy of this in your mail box!

- LOGGING OUT: Remember to log out of your ITax Account… more so if filling @ a cyber café….. For security and integrity reasons!