NAME OF SACCO; Imarika Sacco

BRIEF DESCRIPTION OF THE SACCO;

The sacco was at first Malindi Teachers Sacco then Kilifi Teachers Sacco before its current name Imarika Sacco.

The Sacco has grown to a membership of more than 38,000 members across Kenya and in the Diaspora, we have resolved to rebrand and become the essence of our brand – a stable and secure financial institution that assures its members of security and growth.

HOW TO JOIN, REQUIREMENTS

One can join the Sacco by visiting their website or by visiting the Sacco’s nearest branches through the contacts listed below.

SERVICES, LOAN PRODUCTS OFFERED

ORDINARY SAVINGS ACCOUNT

Account opening fee of Ksh 600

Minimum opening balance of Ksh 1,000/-

Free balance inquiry

Linked to ATM and mobile banking services

Statement requisition ksh30/-

Minimum interest earning balance ksh2000/- and rate is as determined by the Board

SCHOOL FEES ACCOUNT

Ideally this account is to enable members save for school fees

Open to all members

Minimum deposit ksh1,000/-

A/c to have regular deposits

Minimum interest earning balance 2,000/- rate is as may be determined by Board

On request by the member, the SACCO can pay fees directly to the school.

Free statement of a/c every quarter.

HOLIDAY ACCOUNT

Ideally this account is to enable members save for their holidays

Open to all members

Minimum deposit ksh1,000/-

A/c to have regular deposits

Minimum interest earning balance 2,000/- rate is as may be determined by Board

Free statement of account every quarter.

MEDICAL ACCOUNT

Minimum opening balance Ksh1,000/-

Regular deposits

No restrictions on withdrawals

Minimum interest earning balance Ksh 2,000/- rate is as may be determined by Board

Free statement of account every quarter.

EKEZA SAVINGS ACCOUNT

No minimum balance

Earn interest at Kshs. 5,000

The best interest rates

Loan is after six months savings through Mavuno tele loan

MAVUNO TELE LOAN

This is the loan for businessmen and women who have the Ekeza Savings Account. As long as you save regularly you can borrow your average savings!

Applicable to starting or existing businessmen

48 months maximum repayment period

Loan secured by collateral or guarantors

CURRENT ACCOUNT

This account is a strategic solution aimed at offering operational solutions to members who operate business ventures.

Benefits of current accounts.

Enables mulitiple payments

Security of transactions/ cash

Facilitates Record keeping

Facilitates Bulk payments

Eliminates the need to visit any of the Branches

Cost effective

Free quarterly statements

Imarika current account features

Opening balance Kshs. 1000

Free quarterly statements

No below minimum balance fee

Monthly account maintenance fee

Unlimited withdrawals

Competitive interest rates over (Ksh. 250,000/=)

Cheque book.

FIXED DEPOSIT ACCOUNT

This account enables members to save lump sums in their possesion, with an aim to invest in a given project in the near future.

Minimum deposit amount Ksh. 10,000/=

Minimum interest earning period 3 months

Attractive interest rate which is negotiated based on amount fixed and period

Has an option of pre-mature withdrawal and re-investment.

MSCA SAVINGS

The MSCA savings is a weekly contribution made by every member of a MSCA group with the aim of acquiring a loan. The total premiums contributed after ten (10) weeks and above by a member is what will be used to determine the amount of loan to be given to the member when he/she comes to borrow.

HOW TO SAVE IN THE SACCO

DIVIDENDS PAID BY THE SACCO

REQUIREMENTS FOR LOAN APPLICATIONS, INTEREST RATES, REPAYMENTS

SACCO CONTACTS, WEBSITE, EMAIL, PHONE,

Address:Kitecoh Complex, P.O. Box 712, Kilifi

Email:info@imarika.org

Phone:041-7522572/7525017

Fax:041-752 5001

SACCO OFFICES AND BRANCHES LOCATIONS AND CONTACTS

Malindi Town

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans)

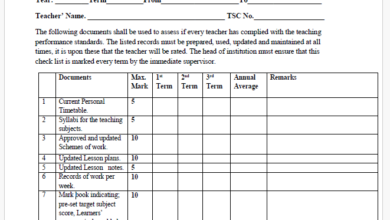

Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans) Latest TPAD Teacher’s Checklist of TSC Professional Documents

Latest TPAD Teacher’s Checklist of TSC Professional Documents Official Kuppet BBF Guidelines For All Branches

Official Kuppet BBF Guidelines For All Branches