Savings And Credit Co-Operatives (SACCOs) have become more popular with customers looking for cheaper and flexible loan products. One of such SACCOs operating in Kenya is the Imarika SACCO. Imarika is a Kiswahili term for “become stable”.

Imarika SACCO was registered on 14th, September, 1974 with about 100 members who were employees of Teachers Service Commission (TSC) in KILIFI District. Currently the SACCO has an active membership of about 38,000 with its head office in KILIFI town with five branches in MALINDI, MTWAPA, KALOLENI,GARSEN,UKUNDA and a service center at BAMBA in Ganze District.

Its core objective is to provide a savings avenue to members and advancing loans to them at an affordable rate of interest. In 1998 the SACCO opened its common bond and admitted other categories of membership. Today it has three major activities namely:

- BOSA – For all members operating through check off system

- FOSA – For business people operating through standing orders

- MSCA – For group members of between 10-30 registered with social services and operating through the group accounts

The membership of the SACCO covers the entire KILIFI County and to some extent beyond the county into the neighboring counties of the Coast province.

DESCRIPTION OF IMARIKA SACCO SERVICES

The major activity of the SACCO is to offer Savings and Credit products to her clients/members and in doing so we seek to address the standard practices a member expects, time lines and the cost factor for such service if any under (BOSA, FOSA & MSCA) for efficiency and productivity. The SACCO also addresses issues of the prospective members seeking to join the SACCO (Membership registration, withdrawals and re-admission) and general guidelines affecting our clients/members.

IMARIKA SACCO PRODUCTS AND SERVICES

Imarika Sacco being a savings and credit co-operative society gives credit to its members. The capital used to offer this credit mainly comes from the savings from its members. The society majorly relies on member’s shares/long-term deposits and FOSA premium savings to conduct its core business of credit advancement.

Like the loans, the society has over the years developed several savings products to boost its capital base thereby enabling it conduct its business smoothly.

Each savings product has specific features that define it and being a member driven institution, all the savings products earn the member some sort of return. Each of the savings products has a specific purpose and therefore the savings products are broadly categorized as withdrawable and non-withdrawable.

The society, in addition to the savings products that it offers, it also has an insurance/security fund that it runs for its members. Each member is required to pay Kshs. 100 every month as insurance. This sum insures the member against death. Upon the demise of a member, the insurance clears any loan that the member had with the Society and also refunds to the member’s next of kin the shares amount held as at the time of death.

MALAIKA JUNIOR SAVINGS ACCOUNT

This account aims at enabling members secure their child’s future. Open the Malaika Junior Savings Account and teach them early how to Imarika with the free Parrot Bank!

- Kshs. 2000 Minimum Balance

- Best interest rates

- Earning interest from Kshs. 3000

- Withdraw 3 times a year

- Invitations to Malaika Junior Parties and events every December*

- *For accounts with Kshs. 10,000 and above and over 6 months

ORDINARY SAVINGS ACCOUNT

- Account opening fee of Ksh 600

- Minimum opening balance of Ksh 1,000/-

- Free balance inquiry

- Linked to ATM and mobile banking services

- Statement requisition ksh30/-

- Minimum interest earning balance ksh2000/- and rate is as determined by the Board

SCHOOL FEES ACCOUNT

Ideally this account is to enable members save for school fees

- Open to all members

- Minimum deposit ksh1,000/-

- A/c to have regular deposits

- Minimum interest earning balance 2,000/- rate is as may be determined by Board

- On request by the member, the SACCO can pay fees directly to the school.

- Free statement of a/c every quarter.

HOLIDAY ACCOUNT

Ideally this account is to enable members save for their holidays

- Open to all members

- Minimum deposit ksh1,000/-

- A/c to have regular deposits

- Minimum interest earning balance 2,000/- rate is as may be determined by Board

- Free statement of account every quarter.

MEDICAL ACCOUNT

The medical savings a/c is designed to enable members save for any eventuality.

- Minimum opening balance Ksh1,000/-

- Regular deposits

- No restrictions on withdrawals

- Minimum interest earning balance Ksh 2,000/- rate is as may be determined by Board

- Free statement of account every quarter.

EKEZA SAVINGS ACCOUNT

This account is for individuals or businesses.

- No minimum balance

- Earn interest at Kshs. 5,000

- The best interest rates

- Loan is after six months savings through Mavuno tele loan

MAVUNO TELE LOAN

This is the loan for businessmen and women who have the Ekeza Savings Account. As long as you save regularly you can borrow your average savings!

- Applicable to starting or existing businessmen

- 48 months maximum repayment period

- Loan secured by collateral or guarantors

CURRENT ACCOUNT

This account is a strategic solution aimed at offering operational solutions to members who operate business ventures.

Benefits of current accounts.

- Enables mulitiple payments

- Security of transactions/ cash

- Facilitates Record keeping

- Facilitates Bulk payments

- Eliminates the need to visit any of the Branches

- Cost effective

- Free quarterly statements

Imarika current account features

- Opening balance Kshs. 1000

- Free quarterly statements

- No below minimum balance fee

- Monthly account maintenance fee

- Unlimited withdrawals

- Competitive interest rates over (Ksh. 250,000/=)

- Cheque book.

FIXED DEPOSIT ACCOUNT

This account enables members to save lump sums in their possesion, with an aim to invest in a given project in the near future.

- Minimum deposit amount Ksh. 10,000/=

- Minimum interest earning period 3 months

- Attractive interest rate which is negotiated based on amount fixed and period

- Has an option of pre-mature withdrawal and re-investment.

MSCA SAVINGS

The MSCA savings is a weekly contribution made by every member of a MSCA group with the aim of acquiring a loan. The total premiums contributed after ten (10) weeks and above by a member is what will be used to determine the amount of loan to be given to the member when he/she comes to borrow.

Download the account opening application form Here

Also read:

-

- All TSC services online portals and how to log in

- TSC TPAD data upload deadline

- Complete guide to the new cTSC TPAD portal

- TSC: Full details on the newly established grades for teachers

- TSC: Designation codes for all teacher job groups

- TSC Grades and qualifications/ requirements for various administrative positions in schools

- TSC: Details on the current all 36 Teacher job groups/ grades

- TSC: Requirements, appointment and responsibilities of Principals

- All what you need to know and carry to a TSC teacher recruitment interview

- TSC: Requirements, responsibilities and appointment of Deputy Principals

These are loan products offered at the Back Office Service Activity (BOSA) which forms the core activity of the society.

LONG-TERM LOANS

These are loans that run for over 36 months. They are aimed at offering flexible repayment schedule to ease strain on the member. They include:-

BOSA LONG-TERM LOAN

DEVELOPMENT LOAN (FORMERLY NORMAL LOAN)

- Approval based on eligibility.

- Granted 3 times one’s share

- Repayment Period is 60 Months.

- Assessment is based purely on salary repayment ability

- Minimum loan amount Ksh.100,000

- Loan processing fees shall be as decided by the Board

- Must be guaranteed

- Loan disbursed within one week of application

- Clearance from CRB (Credit Reference Bureau)

SMART LOAN

- Open to all BOSA Members

- Approval based on eligibility.

- Repayment Period is 72 Months.

- Minimum of Ksh.100,000 in long term deposits

- Loan ceiling of Ksh.5 Million

- Assessment is based purely on salary repayment ability

- Salary to pass through the Sacco

- Must be guaranteed

- At its discretion, the Sacco may consider other form of collateral

- Clearance from CRB (Credit Reference Bureau)

KARIBU LOAN

- Approval based on eligibility.

- Equivalent one month share contribution and a copy of the current pay slip.

- Loan to be granted depends on salary ability ensuring 1/3 remains

- Upon granting of the loan, a quarter of the loan granted is transferred to shares leaving the member with 75% of the loan to withdraw.

- Karibu loan caters for new employees who want to start their life

- Repayment Period is 48 Months.

- Loan processing fees shall apply

- Clearance from CRB (Credit Reference Bureau)

MEDIUM-TERM LOANS

SCHOLARPLUS LOAN

- Approval based on eligibility.

- Repayment Period is 30 Months. Has a minimum amount of Kshs. 41,000 and has no maximum ceiling

- Assessment is based purely on salary repayment ability

SWIFT LOAN

- For BOSA salaried members only, recoverable at FOSA

- Must be within the bracket of 3 times member’s shares

- Applicant must retain1/6 of basic salary as net pay.

- Repayment Period is 36 Months. Has no maximum ceiling.

- The loan must be guaranteed whose shares equates or surpasses the loan requested.

SHORT-TERM LOANS

EMERGENCY LOAN

- To be approved based on eligibility.

- Repayment Period is 12 Months.

- Assessment is based purely on salary repayment ability

SCHOOL FEES LOAN

- To be approved based on eligibility.

- School fees Loans include all loans to cater for education fees.

- Fees structure must be attached to the application form

- Repayment Period is 12 Months.

- Assessment is based purely on salary repayment ability

These are loan products offered at the Front Office Service Activity (FOSA) for members who are banking with the society.

MEDIUM-TERM LOANS

DEVELOPMENT LOAN (FORMERLY NORMAL LOAN)

- To be approved based on eligibility.

- The loan granted 2 times the members premium savings

- Minimum loan amount Ksh.100,000

- Repayment Period is as follows:

Loan from Ksh.100,000- Ksh.399,999- 36 Months

Loan from Ksh.400,000- Ksh.999,999- 48 Months

Loan over Ksh,1,000,000-60 Months

- Assessment is based purely on salary repayment ability/average monthly savings

- To be guaranteed

- Loan processing fee shall be as decided by the Board

- Loan disbured within one week of application

- Clearance from CRB (Credit Reference Bureau)

SCHOLAR PLUS LOAN

- To be approved based on eligibility. The loan to be granted plus the existing loans shall not exceed 2.5 times the members premium savings

- Salary must be passing through the FOSA account

- Repayment Period is 30 Months.

- Minimum allowable amount is Kshs. 41,000. Has no maximum ceiling.

- Assessment is based on salary ability/average monthly savings

UFANISI LOAN

- Available to all FOSA members with pay slips.

- Granted 3 times one’s share

- Repayment period is 48 months.

- Pay slip should be able to meet the loan deductions and be left with 1/3 requirement.

- Assessment based purely on salary repayment ability/ average monthly savings.

- Salary must be passing through the FOSA account

- Must be guaranteed

- Clearance from CRB (Credit Reference Bureau)

SHORT-TERM LOANS

EMERGENCY LOAN

- To be approved based on eligibility. Loan must not exceed 2 times a members premium savings

- Emergency Loans include all loans for taking care of all calamities e.g. hospital, settlement of civil cases etc.

- Repayment Period is 12 Months.

- Assessment is based purely on salary repayment ability/average monthly savings

- Must be guaranteed

SCHOOL FEES LOAN

- To be approved based on eligibility.

- Loan granted 2 times a members premium savings

- Repayment Period is 12 Months.

- Assessment is based purely on salary repayment ability/average monthly savings

IMARIKA VIJANA LOAN

For youth between 18-34 years. At Imarika Sacco, we care about growth of young people. Introducing the Imarika Vijana loan, for young people in youth groups, so that they can build their businesses together or individually.

- Open a Savings Account

- Save regularly

- Show us your business and business plan

- Borrow between Kshs. 40,000 (when having 10,000/= shares)and Kshs. 100,000 (when having 20,000/=)

- Repay in 24 months

- One month grace period

- Sacco Business Support to advice on the business

FOSA ADVANCES

PRESTIGE ADVANCE

- Applicant must be an active member of the society.

- Applicant salary must be passing through his/her SASA Account

- Applicant must have serviced in full any outstanding advance.

- Repayment period ranges from 7-10 months

- Advances are considered on the spot but subject to availability of funds

- Advances should be guaranteed by members of the society whose salary passes through the FOSA Account.

ORDINARY ADVANCE

- Applicant must be an active member of the society.

- Applicant salary must be passing through his/her FOSA Account

- Applicant must have serviced in full any outstanding advance.

- Repayment period ranges from 1-6 months

- Advances are considered on the spot but subject to availability of funds

- Advances should be guaranteed by members of the society whose salary passes through the FOSA Account.

ONE-MONTH ADVANCE

- Applicant must be an active member of the society.

- Maximum advance applied should not exceed 2/3 of net salary

- Applicant salary must be passing through his/her FOSA Account

- Applicant must not be servicing any advance.

- Advances are considered on the spot but subject to availability of funds

- The guarantor(s) must be receiving salary through the FOSA.

ADVANCE TOP-UP

The society allow members to benefit by topping up the existing advance

- Applicant should have an outstanding advance balance

- Maximum repayment period for the new advance balance is dependent on the advance type

- Other conditions of the type of advance being topped up apply.

Below are links to the SACCO’s full list of products and services:

IMARIKA SACCO CONTACTS

For further details, use any of the following media to reach the SACCO:

- Address: Kitecoh Complex, P.O. Box 712, Kilifi

- Email: info@imarika.org

- Phone: 041-7522572/7525017

- Fax: 041-752 5001

More articles on Education matters;

- KNEC- How to download Contracted Professional’s Invitation Letters

- TSC: Detailed guide on using the new TPAD 2 System

- TSC: How to register for AON medical Scheme services via the mobile phone

- The TSC GP69 Medical Form

- TSC: All forms for TSC leaves

- TSC: Latest Designation codes, salaries and job groups for teachers

- KNEC- Guide on how to successfully register candidates for KCSE, KCPE exams

- KNEC: Grading System for KCSE exams

- KNEC- How to correct KCSE, KCPE registration details for Candidates

- 2020 Term Dates for schools and Colleges

- P1 Teacher Training intake news

- KNEC instructions on Grade 3 Learners Assessment

- How to apply for the Kenya Education Fund Scholarships for all learners

- Gazetted School reporting and departure times for teachers and students: School routine

- Education Ministry’s guidelines on Learners’ Discipline

- KNEC: How to revise form one schools’ selections for KCPE candidates

- KNEC Examiners: Here is all that you need to know

- KUCCPS: Instructions for students on admissions to Universities, Polytechnics and Colleges

- KUCCPS: Inter Institution Transfer guidelines and procedure for students

- HELB: This is all you need to know concerning HELB loans application, processing, disbursement and repayment

- HELB: Procedure for applying for HELB loans online

IMARIKA SACCO MOBILE BANKING: SPOT C ASH SERVICE

The good news for Imarika SACCO members is that they can now enjoy a wide variety of services via their mobile phones. With your mobile phone at hand, you can now access many services at a click of a button.

SERVICES ACCESSED THROUGH THE MOBILE

Registration for SpotCash Mobile services is absolutely free by dialing *645#. Here are the mobile banking services for your convenience and reliability:

- Cash deposits and withdrawals.

- Balance inquiry.

- Savings

- Loans

- Shares

- Airtime purchase

- Mini Statement

- Funds transfer.

BENEFITS

There are many benefits that are obtained by using Imarica SACCO’s mobile banking. These include:

- Accessing your account any time, anywhere.

- Saves your time and energy.

- Faster and reliable

- Keeps you informed about your account; alerts on loans, salary, cheque maturity, ATM and guarantors.

- You can borrow money at your own comfort (Mkopo Hewani).

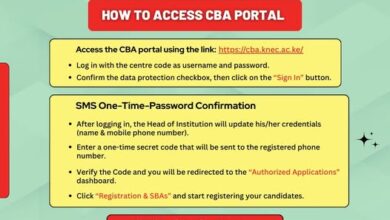

Knec CBA Portal For Parents (https://cba.knec.ac.ke/parent-login)

Knec CBA Portal For Parents (https://cba.knec.ac.ke/parent-login) Knec Registration of candidates for 2026 KJSEA {Official Guide}

Knec Registration of candidates for 2026 KJSEA {Official Guide} Rang’ala Girls Senior School’s Complete Details

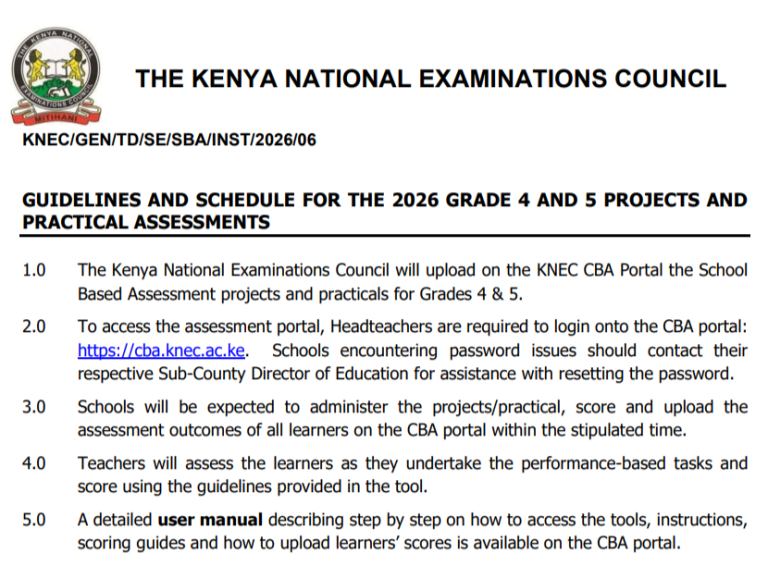

Rang’ala Girls Senior School’s Complete Details Knec official guide for 2026 Grade 4 and 5 projects and practical assessments

Knec official guide for 2026 Grade 4 and 5 projects and practical assessments