BACK-OFFICE SERVICE ACTIVITY (BOSA)

Back Office Services Activities (BOSA) in Mwalimu National enables members to make deposits and allows them to borrow against these deposits at very competitive interest rates.

Mwalimu National using its experience of over 40 years has developed and

continues to review tailor made credit products that meet our member’s needs.

THE PRODUCTS OFFERED UNDER BOSA INCLUDE:

(i) Emergency Loans:

These loans essentially help members meet emergency financial needs such as hospitalization, bills that may fall due suddenly and unforeseen circumstances.

Product features:

• Repayable in 24 months

• Only one emergency loan can be granted at a time

• Emergency loans are given within a member’s entitlement

• Maximum limit is a members’ deposits x 5 (subject to 1/3 salary rule and ability to repay within twenty-four months)

• Principle loan repayment is done separately from interest repayment.

(ii) School Fees Loan:

Mwalimu National offers members the school fees loan product to enable them to cater for their educational needs as well as their children’s school fees without straining.

Product features:

• Repayable in 24 months

• Only one school fees loan can be granted at a time

• School fees loan is given within a member’s entitlement

• Maximum limit is a members’ deposits x 5 (subject to 1/3 salary rule and ability to repay within twenty-four months)

• Principle loan repayment is done separately from interest repayment

(iii) Normal Loan:

The normal loan is a short-term loan intended for investment purposes, also enables members to acquire assets.

Product features:

• Repayable in 36 months

• Only one normal loan can be granted at a time

• Maximum limit is a members’ deposits x 3 (subject to 1/3 salary rule)

• Principle loan repayment to be done separate from interest repayment

(iv) Development Loan:

This is a medium-term loan intended to empower members to undertake investment activities and address development needs.

Product features:

• Repayable in 48 months

• Only one development loan can be granted at a time

• Maximum limit is a members’ deposits x 4 (subject to 1/3 salary rule)

• Recovery is done at a monthly flat rate combining principle repayment with interest.

(v) Super Loan:

Super loan is a long-term loan granted to members to enable them undertake development projects, property acquisition and other investment activities for long-term benefits.

Product features:

• Repayable in 60 months

• Only one super loan shall be granted at a time

• Maximum limit is a members’ deposits x 4 (subject to 1/3 salary rule)

• Recovery to be done at a monthly flat rate combining principle repayment with interest.

(vi) Vision Loan 84:

This loan is specially tailored for members to finance long-term development projects and meet investment needs. The product’s longer repayment period and higher deposit multiplier makes it suitable for this purpose.

Product features:

• Repayable in 84 months

• Only one vision 84 loan can be granted at a time

• Maximum limit is a members’ deposits x 5 (subject to 1/3 salary rule)

• Recovery is done at a monthly flat rate combining principal repayment with interest.

• Processing fee of 1% paid upfront

(vii) Wezesha Loan:

A loan product for new members who have ability to pay a loan but have no sufficient deposits to qualify for one. A small portion of the applied loan amount is retained as a member’s shares while we issue out to the member the remaining amount.

Product features:

• Maximum amount loanable is determined by the member’s ability subject to 1/3 salary rule.

• Processing fee of 2% paid upfront

• Repayment period is 48 months and the loan must be fully guaranteed

• The product is only issued to new members and not readmitted members.

• The member’s salary to be channeled through Mwalimu National Sacco FOSA.

• Recovery is done at a monthly flat rate combining principle repayment with interest.

(viii) Ufanisi Loan:

This is long-term loan product aimed at enabling members with salary ability but have low shares to access more credit by boosting their shares. A portion of the loan applied is retained as deposits enhancing the members balance multiplier.

Product features:

• Repayable in 72 months.

• 10 % share boosting fee applicable.

• Minimum deposits prior to the application Ksh200,000.

• Loan must be fully guaranteed

• Only one Ufanisi loan can be granted at a time.

• The member’s salary to be channeled through Mwalimu National Sacco FOSA.

• Recovery is done at a monthly flat rate combining principle repayment with interest.

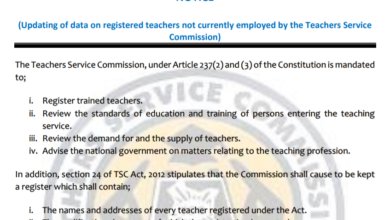

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans)

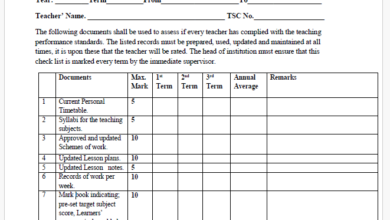

Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans) Latest TPAD Teacher’s Checklist of TSC Professional Documents

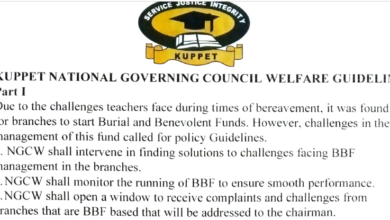

Latest TPAD Teacher’s Checklist of TSC Professional Documents Official Kuppet BBF Guidelines For All Branches

Official Kuppet BBF Guidelines For All Branches