In line with improving Mwalimu SACCO’s provision of financial services and products, the SACCO is pleased to inform members that the interest rate for their M-loan product has been revised to 4% per month. This product is available to members whose salaries are paid through FOSA and members who have SAYE accounts in FOSA. For more information, please reach us on 0709898000 or on our free SMS line 20156.

Mobile services.

Go-Mobile

Go-mobile is a mobile banking system that enables members transact at the comfort of their home or offices.

Do your banking from wherever you are through Mwalimu National’s new downloadable App or via short code *286*51#. The app is available on Android, ITunes, windows etc. With Go-Mobile you are able to:

- Transfer money

- Check your account balance

- Access your mini statement

One needs to register for the Go Mobile service at the nearest Mwalimu National FOSA branch. Upon activation, he/she will receive a username and M-pin. Members should change their M-pins the first time they access this service. In case of further queries, kindly contact Mwalimu National on 0709 898 000.

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Porta

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

MWALIMU SACCO LOANS.

Why SACCO Loans are better

SACCO loans DO NOT have hidden charges but Bank loans have A LOT OF HIDDEN CHARGES besides monthly charges. Some of these charges include:

- Insurance fee.

- Appraisal/ Processing Fee

- Account Maintenance Commission

- Accrued Interest Charges (Arrears Account)

- Late Remittance charges

- Premature Loan Clearance charges.

NOTE: Banks have yearly reappraisals to determine interests to charge. This implies that the interest rates will vary within the lifespan of the loan. As and when interests in the money market change (upwards), the interests on running loans are also adjusted (upwards) without giving notice to the loanee.

A). BOSA LOAN PRODUCTS

Back Office Services Activities (BOSA) is a department in Mwalimu National which offers various loan products against members’ deposits.

Wezesha Loan

Unlike ALL other products, WEZESHA (to enable) is the ONLY product that a member does not have to wait for six (6) months before applying for a loan. Mwalimu National enables YOU (new member) to access funds of up to Kshs 600,000 immediately your first savings deduction goes through. ONLY 1/3 of Kshs 600,000 will be retained in the new members account as savings.

Terms and conditions of wezesha loan

- This product is for new members only.

- Rate is 13% p.a on reducing balance.

- Wezesha loan runs for a maximum of 36 months

- 2% wezesha processing fee shall be charged on the amount to be advanced.

- Maximum loan amount to be issued shall not exceed Ksh.600, 000.

- The loan should be fully guaranteed.

- The minimum period for a member to qualify shall apply as per the sacco by-laws.

- Shares boosted shall earn dividends on pro-rata basis.

Emergency Loan

- Granted for unforeseen circumstances.

- Applicable interest rate is 1%p.m on reducing balance.

- Repayable in 12months.

- Multipler is x5 (subject to 1/3 salary rule).

- Only one emergency loan can be granted at a time.

School Fees Loan

- Granted for education purposes only.

- 1% p.m interest rate on reducing balance.

- Repayable in 12months.

- Maximum limit is a member’s deposit x5 (subject to 1/3 salary rule).

- Only one school fees loan to be granted at a time.

Normal Loan

- Granted as a short term loan aimed at helping members meet their immediet finacial needs.

- 1% p.m on reducing balance.

- Repayable in 36months.

- Limit is a member’s deposit x3 (subject to 1/3 salary rule).

- One normal loan to be granted at a time.

Development Loan

- Granted as medium-term loan for investment purposes.

- Applicable interest rate is 1.17% p.m on reducing balance.

- Repayable in 48months.

- Maximum limit is a member’s deposit x4 (subject to 1/3 salary rule)

- One development loan granted at a time.

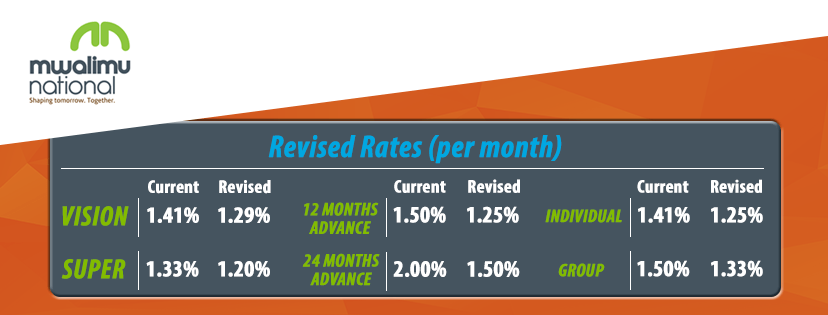

Super Loan

- Granted as long-term loan for investment purposes.

- Interest rate is at 1.20% p.m.

- Repayable in 60months.

- Maximum limit is a member’s deposit x4 (subject to 1/3 salary rule)

- Only one super loan granted at a time.

Vision 84

- Long term loan for investment purposes.

- Interest rate is 1.29 p.m on reducing balance.

- Repayment period in 84months.

- The limit is a member’s deposit x5 (subject to 1/3 salary rule)

B). FOSA PRODUCTS

Front Office Services Activities (FOSA) is the banking arm of Mwalimu National that provides basic and affordable banking services to meet members’ needs.

Salary in Advance

- The Interest Rate is 5%.

- Maximum amount borrowed is 80% of your net salary or S.A.Y.E

- Repayable @ the end of the month

FOSA Instant Credit(24 Months)

- FOSA instant credit (24 months)

- Interest rate @ 1.5% per month on reducing balance

- Repayment period is 24 months.

- Maximum amount granted is your savings under S.A.Y.E x16

FOSA Instant Credit(12 Months)

- Interest rate is 1.25% Per month.

- Repayment period is 12months.

- Maximum amount granted is your net salary x16.

- Maximum amount granted is your savings under S.A.Y.E x10.

M-Loan

Interest rate is dependent on the repayment period in that;

- 1 month @ 5%

- 2 months @ 6 %

- 3 months @ 7%

- Maximum amount a member can borrow is up to 80% of his/her net salary or S.A.Y.E

- Principal and interest amounts are recoverable at the end of each month.

Advance Dividends

This is a percentage of expected dividends that are normally paid earlier.

- The interest rate is between 7.5% and 5% depending on the time a member requests for the advance dividends.

- The maximum amount requested is 75% of your expected dividends.

Important Mwalimu SACCO links:

- Online Application Form

- Website: https://www.mwalimunational.coop

- Members Login Portal: https://membersportal.mwalimunational.coop:82/

C). BUSINESS LOANS.

Individual loan

Clients with well established businesses, can access business loans directly without group requirements. The minimum loan for individual client is Kshs 501,000 and a maximum of Kshs 5,000,000.

Terms

- Individual loans are offered at an interest rate of 1.25% p.m. on reducing balance.

- Our repayment period is between 3-36 months depending on the amount borrowed.

- The loan is self-secured and acceptable securities include logbooks and commercial title deeds.

Group Loans

Business Loans are disbursed to individual members within a group for expansion of existing income generating ventures. Such businesses must have been in operation for at least 6 months.

Group loans are done based on tiers.

- Tier one KSH 30,000 – KSH 150,000 (1.33% pm) payable in maximum 12months.

- Tier two KSH 151,000 – KSH 250,000 (1.33% pm) payable in maximum 24months.

- Tier three KSH 251,000 – KSH 500,000 (1.33% pm) payable in maximum 36months.

One has to start from tier one and graduate through the tiers within the program based on business ability. If successful, at tier three one can move to borrow as an individual client without the need of group.

MWALIMU MASHINANI

Mwalimu National SACCO has rolled out agency banking- MWALIMU MASHINANI; which has been piloted in the following regions:

Also read:

- All TSC services online portals and how to log in

- TSC TPAD data upload deadline

- Complete guide to the new cTSC TPAD portal

- TSC: Full details on the newly established grades for teachers

- TSC: Designation codes for all teacher job groups

- TSC Grades and qualifications/ requirements for various administrative positions in schools

- TSC: Details on the current all 36 Teacher job groups/ grades

- TSC: Requirements, appointment and responsibilities of Principals

- All what you need to know and carry to a TSC teacher recruitment interview

- TSC: Requirements, responsibilities and appointment of Deputy Principals