BRANCH ANNUAL GENERAL MEETING 20TH FEBRUARY 2021

NATIONAL CHAIRMAN’S SPEECH

- ECONOMIC ENVIRONMENT

The year 2020 saw the COVID-19 pandemic negatively impacting the Kenyan economy with the growth in GDP projected to grow by 6% in year 2020 revised to 4.7%. The resulting effects had the financial services industry including SACCO’s struggling to stay afloat in view of non-remittances and loan defaults, reduced demand deposits as consumption increased for the households and flat or depressed revenue that have culminated into profit warning by many banking institutions. The result has been crowding out of the private sector lending where institutions preferred to invest in government instruments other than on lending in the wake of potential loan loss. Our SACCO however managed to navigate these shocks to return some encouraging performance amid the pandemic challenges that will still live with us for long.

2.0 OPERATIONAL ENVIRONMENT

2.1 Performance

Despite the effects of the pandemic, allow me to highlight some of our key indicators based on preliminary figures as of 31st December 2020 as follows.

| Item | FY 2020 | FY 2019 | Target

2020 |

2019% Growth | 2020 % Growth | |

| 1 | Membership |

104,544 |

99,629 |

113,953 |

11% | 4.9% |

| 2 | Deposits Portfolio |

41,421,213,129 |

36,904,772,571 |

43.1B |

12% |

12.2% |

| 3 | Loans Portfolio | 37,869,657,727 | 33,561,321,317 |

38.6B |

9% |

12.8% |

| 4 | Turnover |

6,906,727,047 |

6,383,018,013 |

7.25B |

10% |

8.2% |

| 5 | Assets Base |

57,741,819,858 |

52,028,526,652 | 13% |

10.9% |

See also;

- Mwalimu Sacco Branch Annual General Meetings 2021

- Gusii Mwalimu Sacco; Loans, how to join, requirements, offices location and contacts.

- Mwalimu National Sacco loans; BOSA interest rates and loan calculator

- TSC loan application process for teachers at Mwalimu National Sacco

- Mwalimu National SACCO membership; How to be a member, requirements and benefits

The highlights indicate that the year 2020 was not an ordinary one for the SACCO on areas of Membership growth and Turnover which has an impact on rebates to members. Our auditors are finalizing the review of the accounts for submission to the Regulator early next week for approval after which they will be tabled during the ADM for affirmation and adoption by the delegates.

- Policy interventions

In a bid to inspire business growth and in line with out strategic plan 2019 – 2023, the board approved the following measures aimed to address the members plight while balancing the business priorities.

- Review of lending interest rates

Based on the market scanning, the board thought it wise to look at the cost of our loan’s vis a vis what other lenders offer to avoid being priced out of the market while cushioning members on cost of borrowing. The new interest rates were implemented effective January 2021.

- Allowing use of PAYE concession

The board upon consideration of the potential risk allowed the use of 5% PAYE concession granted by the government to cushion taxpayers against the effects of COVID-19 effective the month of August 2020. This move resulted into enhanced demand for loans for the three months surpassing our target by amounting to Ksh2.4Billion cumulatively for the three months to October 2020.The utilization of the PAYE relief continued until end of December 2020 after which the government withdrew it. We are glad that we granted our members an opportunity to take up loans using the ability at a time when the focus was on easing suffering that Kenyans were experiencing following disruption of normal lives by the pandemic.

- The prudential ratios

The board held round of consultations with the delegate branches countrywide in November 2020 regarding the status of the SACCO compliance with prudential ratios prescribed by the industry regulator, SASRA. It is a requirement that SACCOs maintain a minimum of 8% of Institutional capital ratio and 10% Core capital ratio. These two ratios measure the reserve strength of any financial institution which we must endeavor to always comply.

This year, we look forward to more policy interventions that will result in better returns through product reviews and reengineering. We also expect to align our services to financial rapid changes taking place within the digital applications and infrastructure.

3.0 SUBSIDIARIES:

- MWALIMU ASSETS MANAGEMENT

In the year 2020, the board reorganized its operations with a view of fast tracking the sale of the houses and recover what is owed to the SACCO. However, with the incoming of the pandemic, the initiatives were negatively impacted but the board remains optimistic that this year 2021, there will be a considerable progress to offload this property off MNS hands to refocus our energy to the SACCO business.

- SPIRE BANK

The board of the SACCO as well as of the Bank embarked on aggressive search for a potential investor to take up a huge change of ownership of its shares and cut down the equity percentage held by the SACCO during the year 2020. A few suitors have come forward expressing their interest with discussions ongoing. We remain hopeful that we shall be able to close on this transaction during this year 2021.

4.0. FUTURE OUTLOOK:

Our strategic focus remains underpinned on the four Key Result Areas which are.

- Business growth.

- Customer service.

- Technology.

- Governance, risk management and compliance; and

- Human capital

In view of shift in the strategic assumptions and the operating environment, the mid-term review scheduled for this year 2021 in quarter three will offer an opportunity to re-look at our dream for this great institution. One of the key assurances I would want to promise here we shall not initiate any capital-intensive venture as we seek restore the financial health of the SACCO which looks promising.

Some of the key initiatives aimed at revolutionizing our operations include.

Deployment of the Core Banking System (CBS)

We successfully migrated to the new CBS on 1st February 2021 and we have been serving members now for 3 weeks albeit with some expected teething problems. I take note that there could have been some inconveniences during the first week after go-live but thank God our technical team was able to respond quickly to resolve emerging challenges. I also thank our members for their understanding during this transition period. Let me give you my unequivocal assurance and comfort that you will soon enjoy the efficiency of the new system and I ask for your indulgence.

On-line loan application and guaranteeing

To reduce inconvenience to members and manage turnaround time, the SACCO aims at integrating this platform to the new Core Banking System to allow for online submission and guarantee of specific loan products to reduce the turn-around time.

The digital finance initiative

One of the key considerations in the year 2021 is to undertake focused research premised on critical data analytics aimed at leveraging on emerging technologies around Digital Finance platforms for service efficiency.

Thank you,

Wellington Otiende

National Chairman

Mwalimu National Sacco.

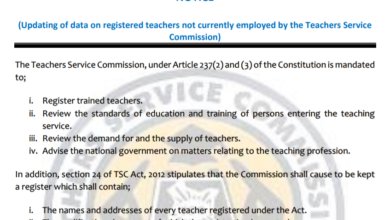

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans)

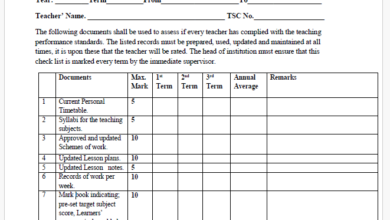

Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans) Latest TPAD Teacher’s Checklist of TSC Professional Documents

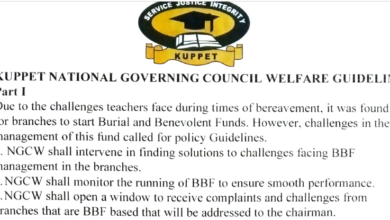

Latest TPAD Teacher’s Checklist of TSC Professional Documents Official Kuppet BBF Guidelines For All Branches

Official Kuppet BBF Guidelines For All Branches