TEACHERS SERVICE COMMISSION

GUIDELINES ON MANAGEMENT OF PAYROLL CHECK-OFF FACILITY

1. INTRODUCTION.

The Teachers Service Commission (“the Commission”) is established under Article 237 (1) of the Article 237 (2) of the Constitution mandates the Commission to: register trained teachers; recruit and employ registered teachers; and assign teachers under its employment to serve in public schools/institutions. The operations of the Commission are further guided by the Provisions of the Teachers Service Commission Act No. 20 of 2012 (“the Act”).

Under the Act, the Commission is further empowered to formulate policies to achieve its mandate; provide strategic direction, leadership and oversight to the secretariat; manage the payroll of its employees; and do all other things as may be necessary for the effective discharge of its functions and the exercise of its

Similarly, the Employment Act and the Labour Relations Act requires the Commission as an employer to uphold and promote good industrial relations with its employees and other stakeholders so as to promote sound Labour

The Commission in 2014 developed guidelines to aid in the management of payroll check-off These guidelines have been in use for 6 years and there is a need to be review them to address emerging issues. The review has also been necessitated by the newly developed T-Pay platform currently being used by the Commission in management of Third Party check off facility.

2. DEFINITIONS OF TERMS

These Guidelines may be cited as the “Teachers’ Service Commission Guidelines on Management of the Payroll Check-Off ”

In these Guidelines: –

“ability” means having the financial means of at least one-third 1/3 of the basic salary drawn by an employee or such limit or criteria as may be set by the Government from time to time to accommodate a deduction.

“applicable law” means any law, rule or regulation having the force of law that guides the check-off facility.

“by-product” refers a report of a transaction or a series of transactions containing a report/ data extracted from the payroll.

“check-off system” refers to a payroll facility that an employer uses to deduct a portion of an employee’s salary/remuneration to effect statutory and voluntary deductions.

“Commission” means the Teachers Service Commission. “employer” means the Teachers Service Commission.

“contact person” means a person designated by the organizations/institutions to manage the check-off facility.

“data” means information required to effect the deductions on the check off facility.

“deduction code” means a unique identity issued by Government to authorize the holder to use the check-off facility in the Government payroll.

“deduction code holder” means a firm or institution holding or authorized or issued with a code by the government to use on the payroll check off facility.

“employee” means a person who for the time being is in the employment of Teachers Service Commission.

“guarantor” means an employee who assumes financial responsibility of another in the event of default or failure on the part of the employee to meet his/ her financial obligations.

“one third (1/3) rule” means the net amount an employee must retain after all deductions have been made.

“data schedule” means the format in which the 3rd party’s data or information for check-off is submitted.

“memorandum of understanding” is the instrument signed between the Commission and the 3rd party on the management of check-off services.

“major complaint” means complaints where fraud is seen, or the issues in question is weighty, complex and requires a detailed analysis and consideration.

“statutory obligations” means deductions due to the Government pursuant to the operation of the laws and shall include deductions accruing on account of a court order or fulfillment of any obligation under the law.

“stop order” means instructions issued by the 3rd party or the employee and duly considered by the Commission to stop a specific deduction on the payroll.

“3rd party” means a company or firm or organization or any entity who is a deduction code holder and has met the requirements set by the Commission for accessing the check-off facility.

“voluntary deductions” means any deductions of salary under the written authority of the employee.

“discharged liability’’ means where a party to an agreement has paid or has cleared the amount due in the agreement.

“trade union dues” means monthly subscriptions paid by a duly registered member of a union as a condition of membership.

“confidential information” means all information, data and documents including but not limited to financial status, passwords, personal information, and processes concerning all parties.

3. RATIONALE

In undertaking its mandate to manage its payroll, the Commission has experienced the following challenges with regard to the third Party

Consistent and numerous complaints from employees regarding irregular and unauthorized deduction of their salaries towards 3rd Party

The use of fictitious, forged, erroneous and inaccurate documents by 3rd Parties allegedly from employees for

Failure by Third Party firms to undertake due diligence and physically verify teacher’s identity through Heads of Institutions, thereby giving out loans to impersonators/fraudsters.

Emerging of online/mobile loans issued by Third Party firms without signed contractual agreements.

Negligence/ignorance of employees to safeguard T-Pay system passwords which exposes them to fraudsters.

Failure of employees to read through and understand loan contracts/agreements with Third Party firms thereby complaining later that they were duped.

Delay/failure by Third Party firms to stop deductions where an employee has discharged liability.

The above challenges have impacted negatively on integrity of payroll data and have strained the Commission’s resources in the overall administration of 3rd Parties These inherent challenges have compelled the Commission to review these Guidelines to ensure efficient and effective management of the third party transactions.

The Guidelines shall provide administrative procedures to guide the check-off facility transactions.

4. OBJECTIVES

The overall objective of the Guidelines is to provide regulations on the management of Teachers Service Commission payroll check-off facility.

5. PURPOSE

To streamline and regulate the management of the Teachers Service Commission (TSC) payroll check- off

To establish standard guidelines for managing the facility and mechanisms for enforcing compliance with stipulated Guidelines relating to the payroll check-off facility.

To protect TSC employees from exploitation by 3rd

6. APPLICATION

These Guidelines shall apply to all 3rdparties who are transacting on the Commission’s Check off facility. They shall take effect with effect from 1st April, 2021.

7. ESTABLISHMENT OF 3rd PARTY MANAGEMENT COMMITTEE

The Commission shall establish a Committee known as Third Party Management Committee, hereinafter referred to as the committee, comprising of the following members:-

The Director Human Resource Management and Development who shall be the Chairperson;

The head of IPPD Division who shall be the secretary to the Committee;

The Director ICT or a representative;

The Director Finance and Accounts or a representative;

The Director Legal, Labour and Industrial Relations or a representative;

The Head of Risk Management Division or a Representative;

The Head of Integrity Division

The Head of Corporate Communications

One officer designated to the Committee by the Director HRM & D

The quorum of the committee shall be five

Sittings of the committee shall be held at the Commission’s headquarters at any time as the need may arise and proceedings of such meetings shall be

The Committee shall regulate its own

The Terms of Reference of the Committee shall be as follows:-

To receive all applications from prospective third parties;

To vet all applications received from third parties as per the Third Party Guidelines and other criteria as may be issued by the Commission;

To maintain proper records and documentation for each third party;

Ensure each third party admitted into the check of system executes a con- tract with the Commission;

To evaluate and prepare a report of performance of third parties

To sanction and terminate contracts with third parties

To receive and forward complaints from employees to Audit Directorate

Put in place internal control systems to prevent fraudulent activities on the check off facility;

Receive Investigation Reports from Audit Directorate and act on recom- mendations thereon;

To act on major complaints and communication the same to the third par- ties;

Ensure that the provisions of the third Party Guidelines and contractual agreements are implemented;

The Committee shall present quarterly reports to management detailing among others:

Any fraudulent activities reported during the quarter and actions taken by the Committee;

The status of the check off facility system including challenges, success, and

8. ADMISSION TO THE TSC CHECK OFF FACILITY

An entity that desires to be admitted to the check of facility must meet the follow- ing mandatory requirements.

Income Tax (PIN) Certificate;

Tax Compliance Certificate from Kenya Revenue Authority;

Certificate of Incorporation or Registration;

Deduction Code Holder Authorization Letter from DPSM;

Trading Licenses issued by relevant Government Agencies;

By Laws for SACCOs and Affiliated Social Welfare Associations;

Letter of confirmation from Regulatory Authority of the firm;

In addition to the above, for a third party to be admitted in the Commission’s check off system it must:-

Have been in operation in the Republic of Kenya for a period of at least five (5) years;

Provide certified audited accounts or latest financial statements;

Provide a letter of Recommendation from its Regulatory Authority;

Provide a list of at least three (3) government institutions where it has been granted a check off facility system;

Provide evidence of presence and branch network in at least fifteen (15) Counties except for region based cooperative

All third parties admitted into the Check off Facility shall execute an agreement setting out the terms and conditions of Such terms shall include but not limited to:-

Obligations of the parties (Third parties and TSC);

Period of engagement and renewal clauses; (Renewal should be after every five (5) years subject to positive performance report developed by the com- mittee;

conditions of engagement;

Termination clauses;

Review clause

Fees payable;

9. ONLINE T-PAY (TEACHERS-PAY) SYSTEM

The Commission developed the online T-Pay application platform for employees and Third-party firms to transact check-off deductions. The application has enhanced efficiency in management of Third Party check of

The System further seeks to:-

Enforce the one third rule as per the provisions of Employment Act (2007).

Minimize fraudulent transactions through inbuilt controls;

Empower employees to have control over Third Party deductions against their salary;

Enable Third Party firms manage their data, minimize data entry errors and enhance accountability on deductions against an employee’s salary;

Have Real time data capture hence a reduction on transaction turnaround time;

Reduce operational

The users of online T-Pay application are the employees, the employer and the Third-Party firms.

The obligation of the Employee shall include:-

To initiate all transactions with the preferred Third Party firm, by sending his/her pay slip online.

To complete the process by approving the captured transactions to be deducted against his/her salary before they are loaded on payroll.

To take responsibility and safeguard their online T-Pay system

To provide authentic documents when seeking check-off

To read and understand the contract terms and conditions before signing the legally binding contract/agreement with the Third-Party firm.

To notify the Commission in writing when joining or withdrawing from a third party.

The obligation of the Third-Party firm shall include to:-

Obtain legitimate authority from employees before transacting any facility in the T-Pay system;

Capture, adjust and stop all deductions online for the respective employee as per the signed legally bidding agreement/contract between the employee and the firm.

To upload a soft copy of the contractual agreement at the point of uploading the loan at the T-PAY system

Safeguard employee’s data and confidential information that it has been entrusted with and use it for only the intended purpose as per the Data Protection Act, 2019.

Be held accountable for integrity of data captured on the T-pay

Submit accurate data to the Commission to facilitate 3rd party deductions;

Reconcile its deduction requests against the by-products to avoid duplication or double deduction of the same transaction;

Undertake due diligence to ensure that the documents and data submitted are valid and accurate to facilitate the deductions;

Return/refund the erroneous or irregular remittances to the Commission upon demand or upon detection of the irregularity;

Stop deductions for a discharged liability not later than three (3) days from the date of such clearance by the employee;

Adhere to the Provisions of the Third-party

The obligation of the Commission shall be to:-

Extract all approved data on T-Pay application, verify the same and upload on the payroll;

Receive complaints from employees and forward them to human resource management and development directorate for action.

Stop any unauthorized deduction and inform the relevant third party of the complaint and stoppage of deductions.

Blacklist and deregister any third party firm and/or entity who has been established to be involved in fraudulent deductions in the T-pay system in accordance with the provisions of the agreement.

Reduce from the 3rd party’s subsequent monthly remittances any fictitious, inaccurate or irregular deduction erroneously effected on an employee’s salary whether caused by the 3rd party’s negligence or otherwise and refunded to the affected employee;

The Commission reserves the right to verify and confirm the authenticity and accuracy of any data submitted by 3rd parties before the same is affected on

10. ONE THIRD (1/3) RULE

The Commission shall only effect deductions (both statutory and voluntary) up to a maximum of two thirds (2/3) of an employee’s basic salary through the check- off facility.

It shall be the responsibility of the 3rd parties to ensure that the proposed deduction(s) from individual employees meet the one third (1/3) requirement as

provided for under the Employment Act (2007) and to confirm the ability of the employee to meet his/her obligation.

11. TRADE UNION DUES AND AGENCY FEE

A trade union which has signed a recognition agreement with the Commission as required by law shall have its dues deducted in accordance with Part VI of the Labour Relations Act 14 of 2007 from the salaries of its members who have voluntarily joined, signed and submitted a prescribed membership form and authorized union dues to be deducted at source by the Commission

The Commission shall deduct and pay to a trade union an agency fee from the salary of each union sable employee, who is not a member of the union, but who has benefited from a Collective Agreement negotiated and concluded between the union and the Commission in accordance with Part VI of the Labour Relations Act 14 of 2007

12. STOP ORDER

It shall be the responsibility of a Third Party to stop deductions of an employee who has discharged his/her liabilities with the firm.

A third party shall stop deductions for a discharged liability not later than three

(3) days from the date of such clearance by the employee.

In the event that a third party fails to stop a deduction as provided in sub clause

12.1 above, the Commission, upon receipt of authenticated instructions from the employee, shall stop the deduction without reference to the third party.

In the event a stop order that is not effected and an over payment is made to the third party, the same shall be recovered from the third party’s subsequent remittance and refunded to the employee.

An employee may discontinue voluntary payroll deductions by providing a written notification to the Third-Party For the purposes of this sub-section, voluntary contribution shall not include the un-discharged liabilities of the employee.

The Commission reserves the right to stop any deduction regardless of whether the third party has issued a stop order or not.

13. ACTION AGAINST DEFAULTERS

A third party shall exhaust all avenues within its means, including legal action against a defaulter.

A third party shall notify any Guarantor in writing of the intention to recover the defaulted loan/credit facility.

It shall be an act of misconduct on the part of an employee who willingly or knowingly fails to meet obligations in respect of un-discharged liabilities and the Commission shall exercise disciplinary action against such an employee as per existing regulations.

14. ADMISSION TO THE CHECK-OFF FACILITY

A third party shall seek authority from the Commission to use the TSC check- off facility through formal application by filling the prescribed Application Form (annexed as second schedule) and paying the admission fee at rates that will be determined by the Commission from time to time

On receipt of the application as per sub clause 14.1above, the Commission shall evaluate the suitability of the third party against these guidelines and any other guidelines that may be set from time to time.

The Commission shall communicate the decision of the evaluation process to the third party in writing.

The successful third party will be required to pay Admission fee within 30 days, failure to which the application becomes null and

The Commission shall reserve the right to admit a third party into its payroll check-off facility through the T-Pay

15. RENEWAL OF ADMISSION TO THE CHECK-OFF FACILITY

An existing Third Party shall every five (5) years after admission into the system seek renewal of admission from the Commission to continue accessing the check-off

The Third Party shall follow the application procedure for Authorization of check-off facility as outlined in clause (14) of these Guidelines/

The Applicant shall pay a renewal fee at the rate determined by the Commission from time to time.

Failure to apply for re-admission within 3 months prior to the expiry of the subsisting access to check off facility, will result into the Commission barring the Third Party from submitting any fresh deduction requests, provided that the existing deductions shall continue to subsist to full term, thereafter the Third Party shall stand deactivated from the TSC check-off facility through the T-Pay application.

Upon approval of the new guidelines all the existing Third Party firms are expected to apply for renewal of admission within thirty (30) days, failure to which they will be barred from undertaking any transactions with the Commission as outlined in subsection 15 .4 above.

The Commission shall reserve the right to re-admit a Third Party into the Check off facility.

16. SERVICE CHARGE

A third party shall pay a service charge for processing of deductions, data, information, reports, and/or any other service provided by the Commission;

The Third party shall fully absorb the service charge cost without passing it to the employee;

The applicable rates for service charge shall be as indicated under the schedule 3 and shall take effect from the date of these guidelines;

Service charge shall be reduced from the remittances of the third party at the end of every month;

These rates shall be determined by the Commission from time to

17. TERMINATION OF THE CHECK-OFF FACILITY

Check-off facility shall be terminated by the Commission in any of the following circumstances: –

Failure by the third party to comply with the statutory provisions as well as any Government Regulations and rules relating to third party

In the event that any applicable rules and regulations makes a deduction illegal or not permissible from an employee’s

In the event the third party becomes bankrupt or is de-registered under the

If the third party engages in any practice deemed by the Commission to be fraudulent or illegal on the part of the third party.

For purposes of this section, the Commission shall give or issue fourteen

(14) days notice of its intention to terminate the relationship with the third party.

In the event a third party is refused, barred, suspended or terminated from the use of the check-off facility by the Commission, the third party may appeal in writing, to the Commission for a review of the decision within twenty-one (21)

18. CONTACT PERSONS

A third party shall designate contact person(s) to manage check-off facility matters as shall be provided for in the application form.

The Commission shall designate officer(s) to manage the third party matters relating to the check-off All correspondence on matters relating to third party deductions shall be addressed to the Secretary/Chief Executive.

19. GENERAL PROVISIONS

All third parties and employees shall be subject to these Guidelines and any other regulations which may be developed from time to time in respect of the check-off facility through the T-Pay

Failure by any party to ensure integrity and accuracy of data provided for purposes of the check-off services will be subjected to sanctions stipulated in these regulations.

An employee who engages or encourages or perpetuates any fraudulent practices in respect of the check off facility shall be subject to the disciplinary proceedings as per existing regulations;

In the event that an existing Third Party fails to meet the requirements as stipulated in these Guidelines, such a Third Party shall be barred from submitting any fresh deduction requests, provided that the existing deductions shall continue to subsist to full term, thereafter the Third Party shall stand deactivated from the TSC check-off facility through the T-Pay

Offences with regard to Third Party deductions shall include offences prescribed in the first schedule or any other relevant

The Commission, upon establishing a breach of these regulations, may take any or a combination of the following sanctions against the defaulting party: –

Warning in

Instituting disciplinary process on the

Suspension of the Third Party from the use of the Check-off Facility through the T-Pay application

Barring the Third party from using the Check-off Facility through the T-Pay application.

FIRST SCHEDULE OFFENCES AND ACTS OF MISCONDUCT

For the purpose of these regulations, the following will constitute offences and acts of misconduct in the management of the Check- off Facility.

Submission through T-Pay of inaccurate or misleading data by the Third

Submission of forged documents by the 3rd party and the employee to access check – off services.

Violation of the one third (1/3) statutory requirement by the

Failure on the part of the 3rd party to stop deduction in respect of a discharged liability within the stipulated time.

Failure on the part of the 3rd party to notify a guarantor in writing of intention to recover the defaulted loan/credit facility.

Willingly or knowingly failing on the part of the employee to meet obligations in respect to un-discharged liabilities.

Any act or omission on the part of the 3rd party or employee, which in the opinion of the Commission contravenes these guidelines or any other written

Unauthorized access to an employee’s T-Pay

Unauthorized access to the T-Pay

SECOND SCHEDULE

APPLICATION FORM FOR ADMISSION INTO THE COMMISSION’S CHECK OFF FACILITY

|

TEACHERS SERVICE COMMISSION

|

| APPLICATION FORM FOR PROVISION OF CHECK-OFF SERVICES IMPORTANT INFORMATION

(i) Consideration for approval of the Application will be based on information provided in this form. (ii) Please attach the following documents dully certified by a Commissioner of Oaths/ Notaries Public: – Mandatory Requirements 1. Income Tax (PIN) Certificate; 2. Tax Compliance Certificate from Kenya Revenue Authority; 3. Certificate of Incorporation or Registration; 4. Deduction Code Holder Authorization Letter from DPSM; 5. Trading Licenses issued by relevant Government Agencies; 6. By Laws for SACCOs and Affiliated Social Welfare Associations; 7. Letter of confirmation from Regulatory Authority of the firm; 8. IFMIS Number

In addition to the above, for a third party to be admitted in the Commission’s check off system it must:- 1. Have been in operation in the Republic of Kenya for a period of at least 3 years; |

| 2. Provide certified audited accounts or financial statements for at least three (3) years;

3. Provide a letter of Recommendation from its Regulatory Authority; 4. Provide a list of at least three () government institutions where it has been granted a check off facility system; 5. Provide evidence of presence and branch network in at least 15 Coun- ties except for region based cooperative societies; For Trade Unions 1. Registration Certificate as a Trade Union. 2. Order from the Cabinet Secretary for Labour instructing the Commission to commence deductions 3. A copy of the Registered Recognition Agreement with the Commission. |

|

| 1. APPLICANT’S INFORMATION | |

| A. ORGANISATION PROFILE | |

| Business Name/Organization | |

| Company/ Business Registration No. | |

| Principal Activities (as registered in

Incorporation Certificate) |

|

| IFMIS Number | |

| B. ORGANISATION PHYSICAL ADDRESS/ CONTACT INFORMATION | |

| Postal address and Code | |

| City/town | |

| Street | |

| Building | |

| Floor | |

| Telephone No. | |

| Mobile Number | |

| C. CONTACT PERSON’S DETAILS | |

| Name | |

| Designation/Title | |

| Mobile Number | |

| National Identity No. | |

| D. ORGANIZATION BANK DETAILS | |

| 2. REQUESTED SERVICES (TICK AS APPROPRIATE) | |

|

i) Monthly by -products. ii) Confirmation of client payroll status. iii) Effecting deductions. iv) Remittances of deductions. v) Access to T-Pay Third Party application |

|

Note 1: The current rate of application fees for check off services is kshs.1000 non-refundable.

Note 2: Application fee should be paid within 30 days upon approval of the application failure to which the application becomes null and void. The rates are as outlined below:

Commercial firms 50,000

Saccos and Affiliated Social Welfare Associations 25,000

Trade Unions 25,000

Social Welfare Associations 10,000

For Official Use Only

Application Approved………………………………………….……………………… Not Approved…………………………………………………………………………… Reasons for Non-Approval…………………………………….………………………

Chairperson

Name ………………… Signature …………………………… Date …………………

Secretary

Name ……………………. Signature ……………………………Date ……………

THIRD SCHEDULE NEW SERVICE CHARGE RATES

| Type of organization | Current rate |

| Commercial firms

· Commercial Banks. |

Commercial banks, Microfinance institutions –

Kshs 100.00 per transaction |

| · Insurance firms. | Insurance firms, Hire Purchase – 3% of total

remittances per month |

| · Hire Purchase firms. | |

| · Micro Finance Institutions. | |

| · Savings and Credit Cooperative Societies (SACCOs) | Kshs. 20.00 per transaction |

| · Social Welfare Associations

· Trade Unions |

Kshs. 20.00 per transaction |

FOURTH SCHEDULE TEMPLATE OF AGREEMENT

THIS AGREEMENT (hereinafter referred to as the Agreement) is made on this………………. Day of …………………………………. 20 BETWEEN

……………………….. a …………………………… incorporated in the Republic of Kenya whose registered address is Post Office Box Number …………………….. in the aforesaid Republic (hereinafter referred to as “the Third Party”) which expression shall where the context so admits include its successors and assigns of the one part, and; TEACHERS SERVICE COMMISSION of P O Box Private Bag – 00100, NAIROBI. (Hereinafter referred to as “The Commission” which expression shall where the context so admits include its successors and permitted assigns) on the other part.

Whereas the said Third Party has expressed intention to use and transact on the Commission’ check off facility. Now therefore, it is mutually agreed by and between the parties hereto as follows:

(1) TERM

(1) The term of this agreement is five (5) years commencing on………………………………………………………………………………………………… day

of……………. 20. The term of this agreement may be renewed upon re-application

of admission by the Third Party and approval by the Commission.

(2) THIRD PARTY’S OBLIGATIONS

That the Third Party hereby acknowledges receipt of the Commission’s Guidelines on Management of Payroll Check-off

That the Third Party has read and understood the Commission’s Guidelines on Management of Payroll Check-off

That the Third Party shall act dutifully and undertakes to take full responsibility of the T-Pay Password(s) given and to further use it responsibly and for the intended purpose only during the term.

The Third Party shall comply with all laws, guidelines and regulations affecting the subject matter of this agreement, and in particular abide by the rules, requirements and procedures set out in the Guidelines on Management of Payroll Check-off Facility.

That the Third Party shall not be entitled to assign or transfer any of its rights or duties herein to any person without the prior written approval of the Commission

(3) COMMISSION’S OBLIGATIONS

That the Commission shall without undue delay train the Third Party on the usage and operations of the T-Pay Application upon successful admission to the Check-off facility.

(4) CONFIDENTIALITY

Any confidential information relating to the Commission and the employees made available to the Third Party will not be disclosed to any unauthorized persons and/or used by the Third Party or any of its employees without prior consent from the Commission.

This restriction shall continue to apply after the expiration or termination of this agreement without limit of timelines.

IN WITNESS WHEREOF the duly authorized representatives of the parties have hereunto set their respective hands this………………………… day of …………………………………………. 20……

SIGNED by the representative of )

………………………………. )

in the presence of; )

)

)

Witness )

)

SIGNED by the duly authorized TEACHERS )

SERVICE COMMISSION )

in the presence of; )

)

Witness )

)

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans)

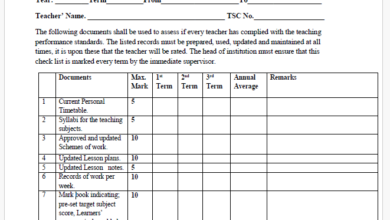

Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans) Latest TPAD Teacher’s Checklist of TSC Professional Documents

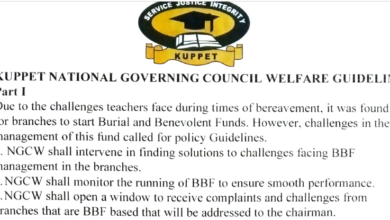

Latest TPAD Teacher’s Checklist of TSC Professional Documents Official Kuppet BBF Guidelines For All Branches

Official Kuppet BBF Guidelines For All Branches