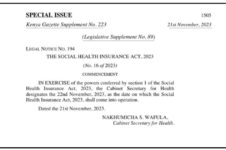

The Social Health Insurance Act 2023 has been gazetted.

Some of my colleagues in HR, some employers and concerned employees have raised some pertinent questions.

I will try to answer them briefly.

1. Are we going to deduct the new rates from November 2023?

The answer is NO. The gazette notice is to make the new social health insurance come into effect but deductions will have to wait for regulations to be published.

2. How much are we going to pay?

Deductions are going to be 2.75% of wages.

Initially, the CS had indicated that deductions would be capped at KSH 5,000.00 but during the launch and even during the Huduma Day celebrations, the president was categorical that there would be no capping.

This implies that 2.75% of your wages will go into this new fund.

3. Are employers going to contribute?

The answer is YES. If you read section 27(1)(e) of the Social Health Insurance Act 2023, it calls out “any other employer”, therefore both employee and employer contribute. Employee 2.75% and employer to match.

4. Are casuals going to contribute to the fund as well?

Yes, they have to. They are employees and the regulations will be clear on how much they will be deducted.

Remember the KRA issued a circular on Affordable Housing Levy (AHL) that made it mandatory for casuals to be deducted.

5. Can an employer opt out of this scheme if they have a robust medical insurance cover?

No, they cannot. Unlike the NSSF Act that provides for Employers to apply to RBA to opt out and contribute their Tier 2 contributions into private pension schemes, with the Social Health Insurance Act 2023, there’s no option of opting out. The fund intends to harness resources to provide medical coverage to all citizens.

6. Will there be public participation in the enactment of the regulations?

Yes, there will be. However, history has taught us bitterly about the outcome of public participation. Refer to Finance Act 2023.

7. When is the probable date when the deductions will come into effect?

All indications are pointing at 1st January 2024. So make provisions in your budgets for the same.

If employers are pushed to match employees’ contributions as called out in the Act then I am seeing a ripple effect on in-house medical covers. The cost of funding both may be out of reach for some employers.

It will call for reviewing our medical covers and even “thinking out of the box”.

Leave a Reply