You probably could have taken a bank loan with the local banking institutions like Equity, KCB, Co-operative and Barclays. If the loan you took is a check off facility (where the employer makes the monthly deductions and sends them to the bank), then you should be very keen on your loan repayment. Otherwise, this loan may turn up to be triple expensive in the long run.

You should be in the know that a check off loan is for salaried Kenyans like teachers employed by the Teachers Service Commission (TSC) and other civil servants. The loan is repaid through monthly installments from your salary. These deductions are then sent to your bank (through) cheque so as to reduce your loan balance.

The monthly deduction amount is divided into two by the bank. The larger portion of this deduction is used to offset the bank’s interest while a smaller portion is used to clear off your principal amount.

For instance, if you took a bank loan and the total amount to repaid is Sh400,000, then, probably Sh150,000 is the Principal amount and the remaining Sh250,000 is the bank’s interest amount (profit). Let us say your monthly loan installment is Sh20,000. Then, this is how the bank clears off your loan. Sh12,000 will be used to clear the bank’s interest, while the remaining amount (Sh8,000) will clear the principal amount.

It is important to note that the interest amount deduction decreases progressively while that for principal amount increases. By progressively, it means that as years go by towards maturity of your loan repayment period.

The amount of of interest paid on a loan facility is dependent on the repayment period. The longer the repayment period the more the interest you will give the bank.

You may also like;

-

Equity Bank Loan for TSC Teachers; How to apply, requirements and repayment schedule

-

KCB Personal Check Off Loan; Loan amounts, Interest rates and Schedule of loan repayment per month

Loan restructuring and how it may affect you.

As opposed to a secured loan facility (where you personally deposit the monthly installments) a check off loan is tricky. You will think you have cleared your loan balance (at the expiry of the repayment period), only to be surprised that the bank is still demanding more.

Whenever your employer (for instance TSC) fails to send the monthly loan deductions,your bank accumulates penalties that you will pay through your teeth.

The work happens when your credit ability reduces within your loan repayment period. Before any further explanation is given on how this will negatively impact on your loan facility, it is important that you understand what credit ability means.

credit ability is the maximum amount of net salary that remains after all deductions have been made from your monthly gross pay. This is the amount you can commit for a loan facility. Please note that this amount should be above and over a third of your monthly basic pay (as per the a third rule).

Now, back to how the reduction in credit ability impacts on your your loan. take for instance, that your net monthly pay is Sh20,000. Of this, Sh15,000 is a third of your monthly basic pay. So, your maximum credit ability should be Sh5,000.

If you approach a bank for a check off loan, this is the amount they will use to give you a new loan. Therefore, after taking the new loan, you will be operation at a monthly net pay of Sh15,000 (which is a third of your salary).

The worst happens when a new statutory deduction (mandatory deduction like the new pension scheme) is introduced on your monthly pay. The statutory deduction does not obey the ‘a third rule’. Consequently, third party deductions like the bank loan installment will be reduced to accommodate the new deduction.

To make this clear to you, if the new pension scheme requires Sh2,000 from your monthly` pay, the Bank loan installment will be reduced by a similar amount. In our illustration the monthly bank installment was Sh20,000 (Check here). This will be reduced to Sh18,000. Eventually, your employer will send the Sh18,000 instead of the Sh20,000 that you had agreed with your bank. This implies that your loan facility will be under funded by Sh2,000.

Because you may not be able to clear your loan balance by the end of the loan repayment period (as a result of the under funding), your bank will restructure your loan by increasing the repayment period. Some banks will inform you in advance on the new developments, but most of them will just restructure your loan ‘silently’.

This loan restructuring is a kind of a loan top up; with an extra principal amount, installment amount and even penalties.

The bank will continue receiving the loan installment from your employer (even after maturity of the agreed loan repayment period) without issuing a stop order (this is a notification from the bank to your employer informing the employer to stop making further deductions from your salary to repay your loan).

What you should do to be on the safe side.

To ensure that your loan facility is running smoothly you need to make regular calls or visits to your bank. This is the surest way of ensuring that your loan facility has no issues.

Another way to monitor your loan facility is by checking your payslip monthly. By so doing, you will be able to ensure that your credit ability (check up here) is fine.

In case your loan facility is under funded, you can always reach an agreement with your bank that you directly deposit the deficit monthly.

Now you know. Be vigilant with your bank loan or else you will pay hefty fines.

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission

TSC Circular on Updating of data on registered teachers not currently employed by the Teachers Service Commission Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans)

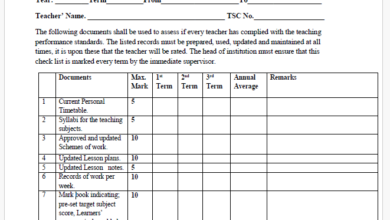

Mwalimu National Sacco Loans & Repayment Schedule (BOSA Loans) Latest TPAD Teacher’s Checklist of TSC Professional Documents

Latest TPAD Teacher’s Checklist of TSC Professional Documents Official Kuppet BBF Guidelines For All Branches

Official Kuppet BBF Guidelines For All Branches