A KRA Nil return is filed by individuals who have the Kenya Revenue Authority, KRA, PINs but are not formally employed. As thus, such individuals do not pay income tax otherwise referred to as Pay As You Earn (PAYE).

TABLE OF CONTENTS

If you have a KRA PIN it is important that you file your returns within the set timelines; usually between January and June of every year. Failure to file Nil returns (just like in other returns) attracts a hefty fine from KRA.

In case you are wondering how file nil returns, worry not as this is the simplest type of return to file. In fact it takes less than one minute on a good network.

All that you are required to have is your KRA PIN and Password to log into your KRA iTax portal. If by any chance you can not recall your KRA password, you can always easily reset it here.

Related content, click on the links below:

- How to file KRA individual tax returns correctly; What you must have and do.

- KRA Tax Returns: How to enable Macros in Microsoft Office Excel when filling Individual income tax

- Step by step guide on how to reset your KRA password

- Simple procedure on how to file 2020 KRA returns, Nil returns, by using your mobile phone’s iTax App

- Simple procedure on how to file 2020 KRA returns, Nil returns, by using your mobile phone’s iTax App

- Step by step guide on how to reset your KRA password

- P9 form for Public servants from the public service payroll portal https://www.ghris.go.ke/ portal: County and national government employees

- TSC P9 Form from Payslips Portal: How to download and use the P9 form for TSC Teachers

- How to file 2020 KRA returns online: Simplified procedure.

- KRA Turn Over Tax, TOT, for traders: Detailed analysis of all other taxes

Login into your iTax account and declaring your nil returns.

To log into your iTax portal account and file your returns, follow the steps below:

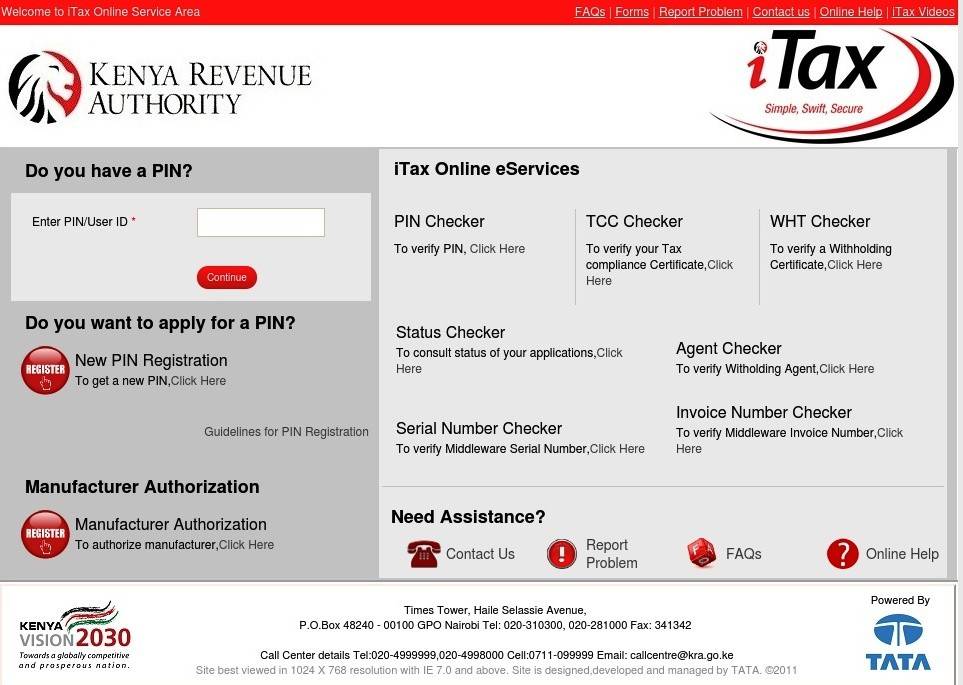

- Visit the iTax portal by using the address; https://itax.kra.go.ke/KRA-Portal

- Enter your KRA PIN and click continue.

- Next, insert your password and security stamp. Select ‘Login’.

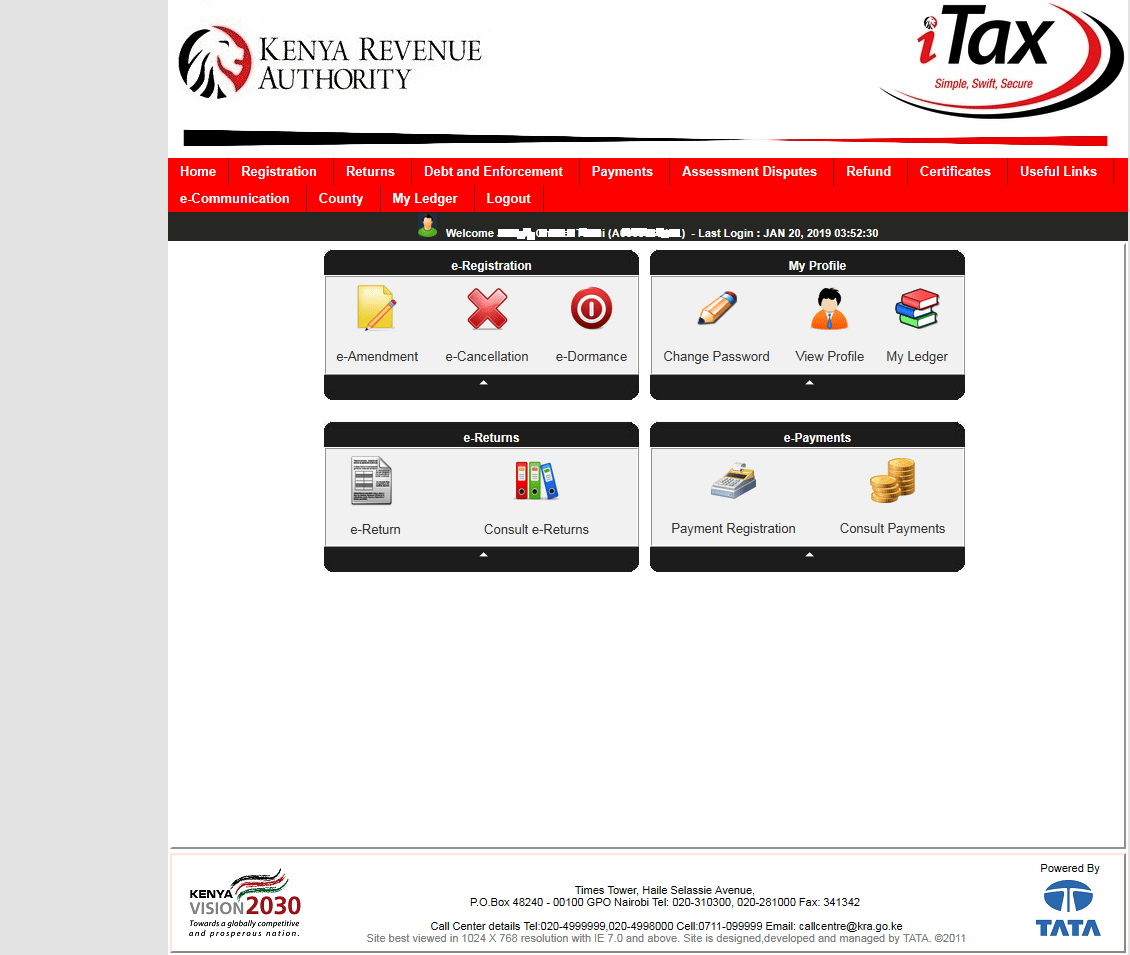

- On successful log in, click ‘Returns’ from the menu bar followed by ‘File Nil Return’.

- In the new window, select the tax obligation. Available options are: Income Tax Resident – Individual(for Kenyans), Income Tax Non Resident – Individual (For foreigners) and Income Tax- Rental income (for landlords).

- Click ‘Next’ to access a new window; with your PIN and return period pre-loaded. Enter your spouse’s PIN; but is not mandatory.

- Select the ‘Submit’ button and a message as the one shown below pops-up;

'itax.kra.go.ke says: Dear Taxpayer, filing of Nil Returns is only applicable in cases where you have NO transactions to declare for the period. Are you sure you want to file Nil Return?

- If your answer to the above query is yes, then click ‘Ok’ to complete the return filing.

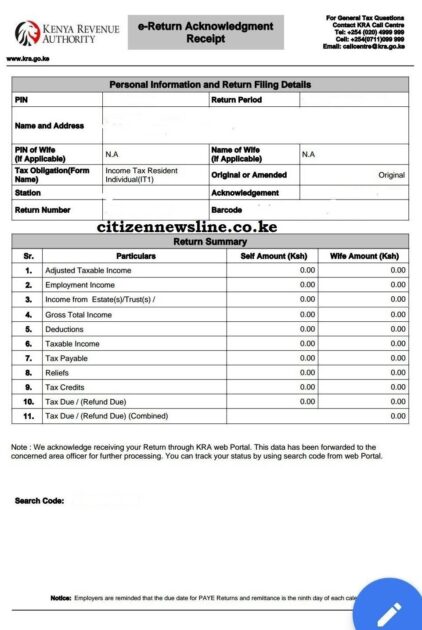

- You will now be redirected to a new window titled..’Return Receipt Generated’.

- Click ‘Download Returns Slip’ to get a copy of your returns file.

- With this, you could have easily filed your nil returns. Quite easy? Try it for yourself.