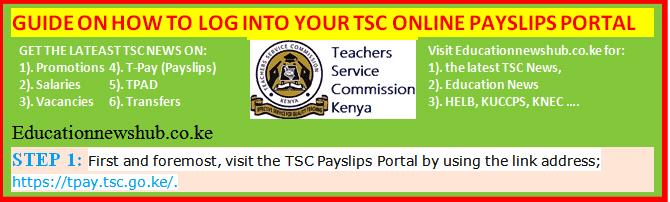

The Teachers Service Commission, TSC, payslip is a monthly generated document that shows the much a teacher earns. The payslip is generated from the TSC payroll and can be downloaded from the TSC payslips portal (T-pay) by using the address https://tpay.tsc.go.ke/

The payslip contains such crucial information as the teacher’s monthly gross pay, allowances and deductions. deductions from teachers’ pay include: Statutory deductions (like Pay as you earn -income tax, National Hospital Insurance Fund- NHIF) and third party deductions.

Join our growing community on Facebook. Click the link below;

OFFICIAL EDUCATION & TSC NEWS CENTRE FACEBOOK PAGE

Teachers remit various amounts to third parties that include teachers’ unions, SACCOs and other deductions. The difference between third party deductions and statutory deductions is that third party deductions are not necessarily mandatory while statutory deductions are mandatory.

You can for example opt out of a deduction towards a Burial Benevolent Fund (BBF) but the same can not happen for individual income tax.

COMPLETE DETAILS ON THE TEACHER’S PAYSLIP

YOUR payslip contains basic information as: the month and year, TSC Number of the teacher, Teacher’s name, Teaching Station, Retirement date, The teacher’s job group/ grade/ designation, ID Number, KRA Tax PIN, the employment terms (either probationary or permanent & pensionable) and the number of years to retirement.

Other details shown on the payslip are: The paypoint (Bank or SACCO name through which salary is remitted), Basic Salary, Allowances (Rental House, Commuter, Special, Hardship as appropriate), Total earnings, Third party deductions (Loans, insurance, medical cover, PAYE, NHIF and other deductions from the teacher’s gross pay), total deductions and then the teacher’s net pay for that particular month.

You can be able to access all your payslips, online, by setting the year and month on the payslips’ home page.

REGISTRATION FOR ONLINE PAYSLIPS AND THE LOG IN PROCESS

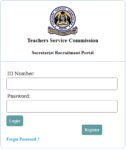

A teacher must first be registered in order to get his/ her payslips online. Initially the process was done online but, now you must visit your local TSC County office for you to be registered. To log into your T-pay account all you need is your TSC Number and Password.

Once registered you can then proceed to log into the T-pay system to view your payslips and P9 forms. The system also provides a function for teachers to send their latest pay slip to 30 parties such as banks, Saccos, among others, to facilitate acquisition of a loan.

SEE ALSO;

- TSC- You will now be able to track status of your third party deductions from your salary

- TSC online services portals and how to log in

- TSC latest interview areas, questions and answers for teacher promotions

- TSC gets new Commissioners: List of TSC Commissioners

- TSC automates process of joining union of choice for new teachers; Applications and all third party teachers’ transactions to be done online.

- TSC intern teachers: confirmation Status on permanent and pensionable terms.

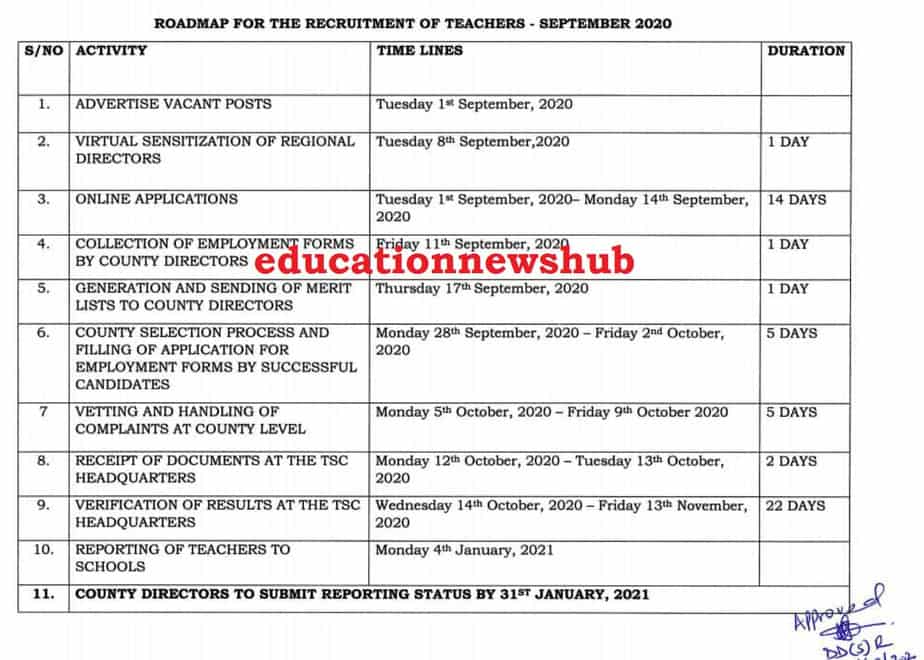

- TSC Teachers’ mass recruitment guidelines and marking scheme.

- Teacher shortages per county: Latest TSC news

- List of all current TSC Commissioners, term of office and their roles

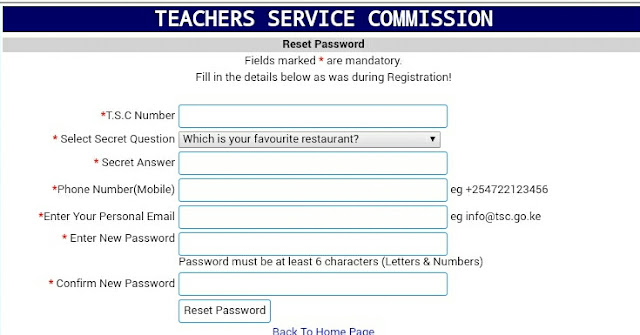

HOW TO RESET YOUR T-PAY PASSWORD.

You can also easily reset your T-pay password. This can be achieved by following the simple steps below;

- Visit the payslips portal at; https://tpay.tsc.go.ke/

- Click on the ‘Forgot password’,

- Fill in the required details; (TSC Number, Select the secret question, provide the answer, enter your phone number, email and password)

- The click ‘Reset Password’.

In case you have any queries or need any assistance, then you can send an email to: [email protected] or call +254 020 289 2158.

Continue Reading:

TSC new online payslip portal at https://tpay.tsc.go.ke/

TSC payslip for 2023 now available online (Login, view and download payslip)

TSC Payslips for July 2024 online

TSC payslip Online

TSC Payslip at T-Pay Portal

Latest TSC Payslip Download for this month

TSC payslip online, July now posted (Login, view and download payslip)

Latest TPAY TSC Payslip Online: Login & View Payslip 2024 (All Months)

New TSC Payslip Login Portal- TPay

TSC Payslips Online; TPay Portal Login

TSC payslip online (Register, Login and download your payslip)

The New TSC Payslips Portal Login plus other Teacher Online Services

TSC Payslips Portal – Tpay Login

TSC payslip online (Login, view and download payslip)

TSC payslip online 2024; Login, download payslips and update your profile

Meaning of abbreviations used on the TSC Payslip

How to view your TSC payslip online- Simplified guide

TSC Payslips; Registration, Login, details, password reset and how to download

TSC Payslip and salary for a newly employed secondary school teacher

Latest TSC payslip online, 2024 (Login, view and download payslip)

TSC payslip online, August (Login, view and download payslip)

TSC Payslip at T-Pay

TSC Payslip Online

TSC payslips online- Here are all the answers to your questions on T-pay

TSC payslip online (Login, view and download payslip)

TPay Portal for TSC Payslips

How to access TSC Payslip Online- TSC Tpay Best Guide

Latest TPAY TSC Payslip Online: Login, View & Download Payslip 2024 Easily

TSC payslip online, October (Login, view and download payslip)

TSC Payslip at https://tpay.tsc.go.ke/

TSC Payslip Online

Tpay – TSC Payslips Online Portal

TPAY profile update on TSC Payslips Portal – Simplified Guide

TSC PAYSLIPS ONLINE PORTAL

TSC payslips online; Login, register and download payslips (T-pay portal https://tpay.tsc.go.ke/)

TSC Payslip for newly recruited graduate teachers

TSC payslip online, December (Login, view and download payslip)