What is Provident Fund appearing on the payslip for civil servants and TSC teachers?

Are you wondering what is the meaning of the new provident fund deduction that is appearing on your payslip? well. The provident fund in your payslip is public service superannuation scheme. It is a deduction for pension for civil servants, teachers, disciplined forces and judges except the Chief Justice and the Deputy Chif Justice.

For men the 2% deduction for this scheme has been taken care of by the Widows and Children’s Pension Scheme (WCPS) that has been stopped.

The deduction will gradually be raised up to 7.5%. The government will provide another 7.5% to make it 15%.

To make the burden lighter for employees, they will contribute only 2% of their basic pay in the first year (2021). In 2022 (the second year), teachers will contribute 5% of their basic pay while the full 7.5% deduction will be effected as from the third year (2023).

Under this scheme, if you quit your current job and join another field, your accrued pension will be transferred to that field.

The scheme will be mandatory for all employees aged below 45 years. On the other hand, the current Public Service Pension arrangement will be closed to all new employees and all serving employees who will be aged below 45 years as at 1st January, 2021. Employees aged 45 years and above as at that date will be given an option to join the new Scheme or remain in the old Scheme.

Read all the details on this scheme here; Government now rolls out the Provident Fund deduction.

Continue Reading:

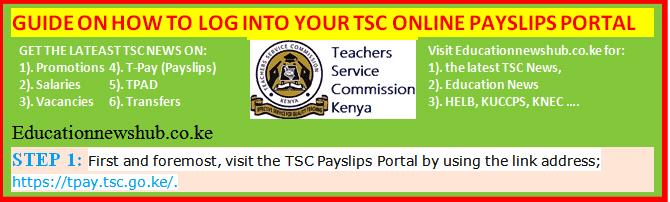

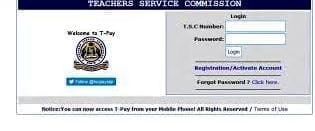

TSC new online payslip portal at https://tpay.tsc.go.ke/

TSC payslip for 2023 now available online (Login, view and download payslip)

TSC Payslips for July 2024 online

TSC payslip Online

TSC Payslip at T-Pay Portal

Latest TSC Payslip Download for this month

TSC payslip online, July now posted (Login, view and download payslip)

Latest TPAY TSC Payslip Online: Login & View Payslip 2024 (All Months)

New TSC Payslip Login Portal- TPay

TSC Payslips Online; TPay Portal Login

TSC payslip online (Register, Login and download your payslip)

The New TSC Payslips Portal Login plus other Teacher Online Services

TSC Payslips Portal – Tpay Login

TSC payslip online (Login, view and download payslip)

TSC payslip online 2024; Login, download payslips and update your profile

Meaning of abbreviations used on the TSC Payslip

How to view your TSC payslip online- Simplified guide

TSC Payslips; Registration, Login, details, password reset and how to download

TSC Payslip and salary for a newly employed secondary school teacher

Latest TSC payslip online, 2024 (Login, view and download payslip)

TSC payslip online, August (Login, view and download payslip)

TSC Payslip at T-Pay

TSC Payslip Online

TSC payslips online- Here are all the answers to your questions on T-pay

TSC payslip online (Login, view and download payslip)

TPay Portal for TSC Payslips

How to access TSC Payslip Online- TSC Tpay Best Guide

Latest TPAY TSC Payslip Online: Login, View & Download Payslip 2024 Easily

TSC payslip online, October (Login, view and download payslip)

TSC Payslip at https://tpay.tsc.go.ke/

TSC Payslip Online

Tpay – TSC Payslips Online Portal

TPAY profile update on TSC Payslips Portal – Simplified Guide

TSC PAYSLIPS ONLINE PORTAL

TSC payslips online; Login, register and download payslips (T-pay portal https://tpay.tsc.go.ke/)

TSC Payslip for newly recruited graduate teachers

TSC payslip online, December (Login, view and download payslip)