If you are a TSC teacher and you are looking forward to applying for a loan from Mwalimu National Sacco, then here is all that you need to know. To apply for a TSC loan, you must be having a basic salary that is more than a third of your monthly basic pay. This means that once the TSC effects the loan check off amount, you should still be having one third of your salary on your payslip.

You also need to note that Mwalimu National Sacco gives TSC checkoff loans to members only. The total loans given to a member should not also exceed five times of his/ her savings.

THE PROCESS USED WHEN APPLYING FOR A MWALIMU NATIONAL SACCO LOAN.

Once ready, you can now apply for your loan from Mwalimu National Sacco. Follow the steps below:

- Just get the loan application form, duly fill it and attach a copy of your National ID.

- Log into the TSC Pay-slip portal and send your payslip online to Mwalimu national. This can be done by logging into the T-pay portal at https://payslip.tsc.go.ke/login.php

- Enter your TSC number and password correctly and click ”Login’

- Once logged in, under third party transactions, select ‘click here to send your payslip’.

- In the next window, select the third party category as ‘Sacco’ and Company to be ‘Mwalimu National Sacco’. You now should click ‘send payslips’. You will get a success message on your screen thus; ‘Payslip for this month has already been sent to a 3rd party’.

- Your Pay-slip will be immediately received at Mwalimu National and the loan application is then processed.

- Once the loan appraisal is complete, you will receive an sms alerting you to login into the TSC pay-slip portal to give your loan consent.

- Log into the TSC Pay-slip portal and click ‘confirm loan’.In the next window, tick the box next to the current loan and click on ‘approve loan’.

- Now select ‘back’ and you will be able to see the loan status as ‘confirmed’.

- Once consent is given by TSC (by seeing the status indicated ‘confirmed’), you will need to alert Mwalimu National in order for the loan to be finalized and funds deposited into your account.

- Please note that approved loans shall be paid through the FOSA account.

RELATED CONTENT

-

- Mwalimu National SACCO Loans; Members now to use tax relief to get loans

- A full list of all Mwalimu National SACCO’s branches across the county: Physical locations and contacts.

- Guide to Mwalimu National SACCO savings, dividends, loans, requirements and many more

- Mwalimu National SACCO makes changes on its loan products; Read the details here

- Mwalimu National SACCO Agency Banking, Mobile loans and App; How to apply for loans via phone

- Mwalimu National SACCO branches countrywide; Location and contacts

- Mwalimu National SACCO members portal login, website and how to join

- Mwalimu National SACCO Loans, Branches, Contacts, Forms, Mobile services, How to join, Website and Portal login

- Mwalimu Nationa SACCO loans and how to apply: Check off, Salary loans

- Physical location, phone and email contacts of the various Mwalimu National SACCO branches in Kenya

INSTRUCTIONS FOR MWALIMU NATIONAL LOAN APPLICATION

Before you apply for the Mwalimu National check off loan, please read and understand the following instructions:

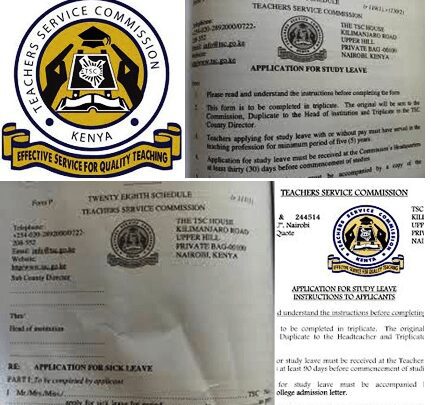

- The loan application must be made the on official loan form fully completed and appropriately signed by both the lonee and guarantors in their own handwriting.

- Loan are granted in accordance with the loan policy and lending conditions existing at the time of application.

- For a member to qualify for a loan consideration, he/she must have contributed shares for a minimum period of three months, subject to the policy in force.

- Any amount of money deposited by a member either in cash or by cheque to boost shares shall wait for six months before that amount can be used to secure a loan.

- A member whose share contributions have fallen off the payroll but has continued repaying his/her loan and is in need of a new loan will be required to update his/her

shares account by repaying in cash or authorize an offset from loan of an equivalent amount of the arrears. - Any member who clears his/her loans by cash/cheque must wait for 2 months before qualifying for a loan consideration subject to the policy in force. A member, whose

loan is cleared through withdrawable Sa v i n g s Fu n d (WSF) will qualify for loan consideration immediately under clearance conditions. For members whose loans shall be bridged through WSF, the loan being processed shall be credited in the WSF account. - Guarantors who must be members of the Society shall not guarantee more than six major loans (Normal, Development, Super and Vision)

- The interest rates shall be determined by the Board of Directors from time to time.

- The amount applied for shall be fully covered by the loanees plus guarantors shares

- Minimum share contribution for those with loans shall be determined by the share banding on the amount approved

- A dormant member shall not be considered for any loan.

- Minimum share contribution for members without loans will be Kshs. 1000.00 per month subject to change from time to time.

- No member will be allowed to suffer deductions including loan repayment in excess of two thirds of the basic salary.

- Members can take a second loan other than emergency/School Fees in addition to existing loan without necessarily clearing the outstanding loan subject to ability.

- Loans shall only be paid to member’s WSF account.

- If a member decides to cancel his/her loan after the process has been finalized a fee of Kshs. 1,000/= shall be charged.

- Any alteration on the loan form may cause disqualification.